CLOSE: SPX Best 20JUN - Take record profits!

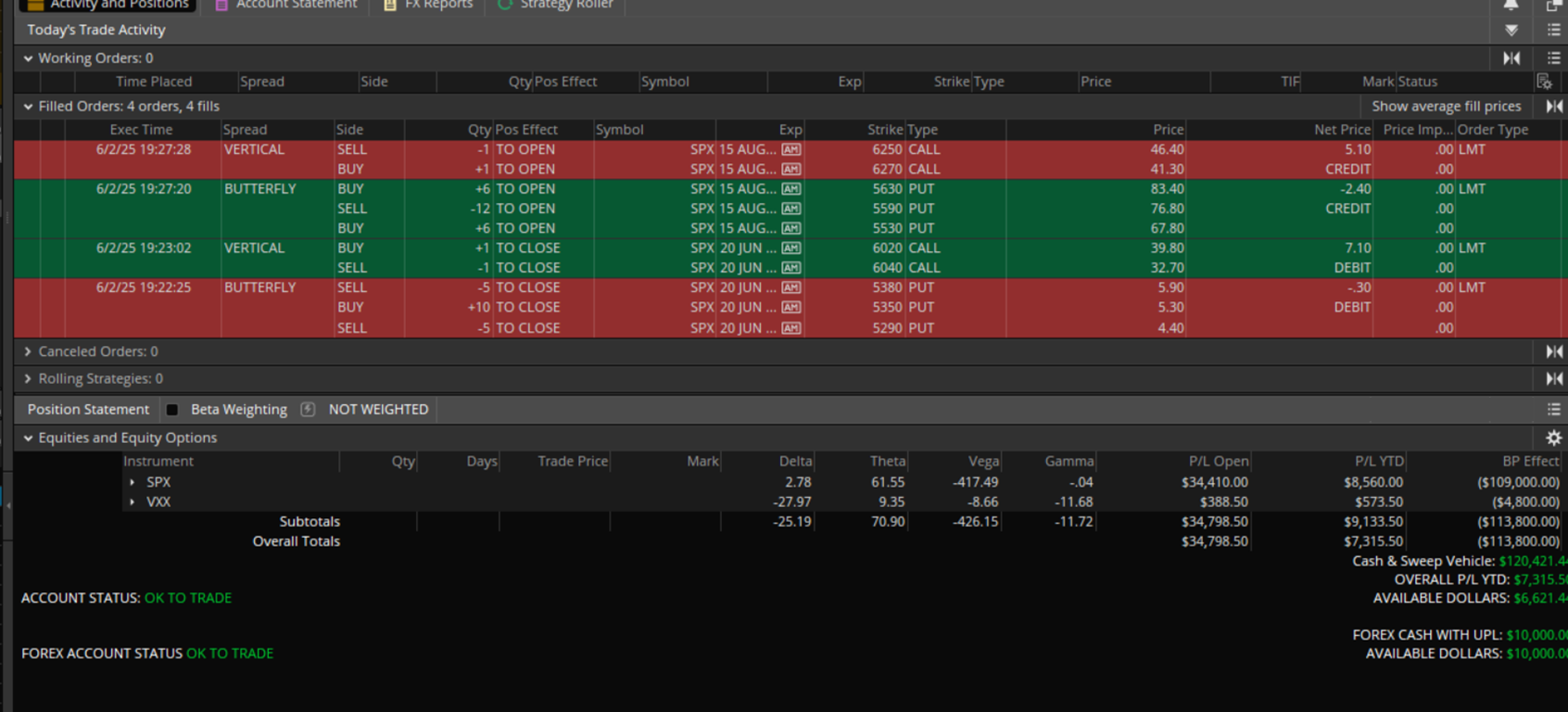

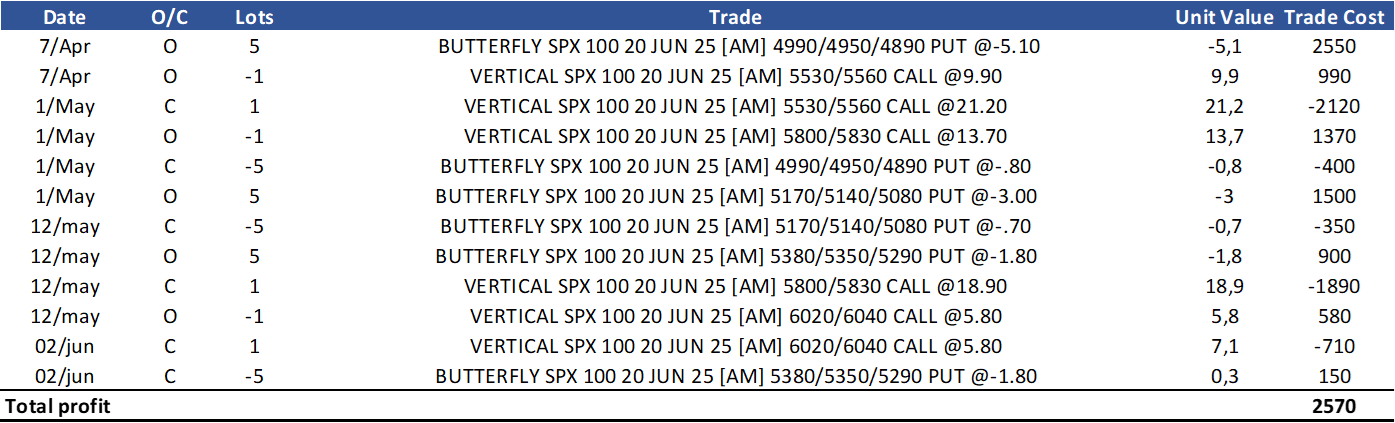

Trade Rationale: Close 2 Jun

With the trade at a record high, trade becoming Delta negative, and SPX continuing to recover, I preferred to close the trade and take the big profit. Then, like always, I will use the free-up funds to open another SPX best Trade far out in time to reduce the overall portfolio risk.

Although there was a big Theta (and increasing), we reached 17DTE, which also brings higher Gamma... no free lunches and it is better to reduce risk and take profits; not being too greedy!

Position finale:

The trade delivered a record profit

-------------------------------------

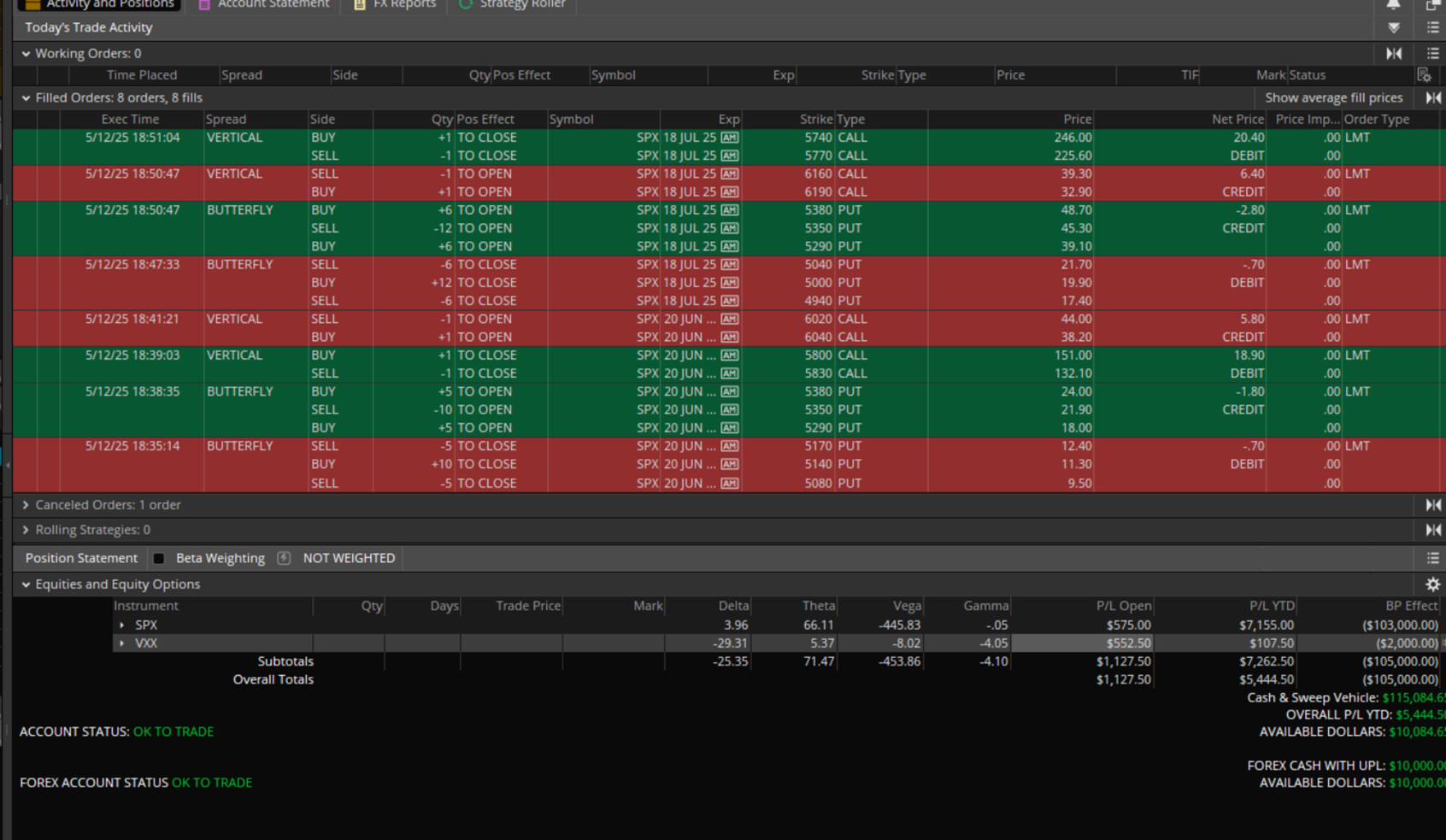

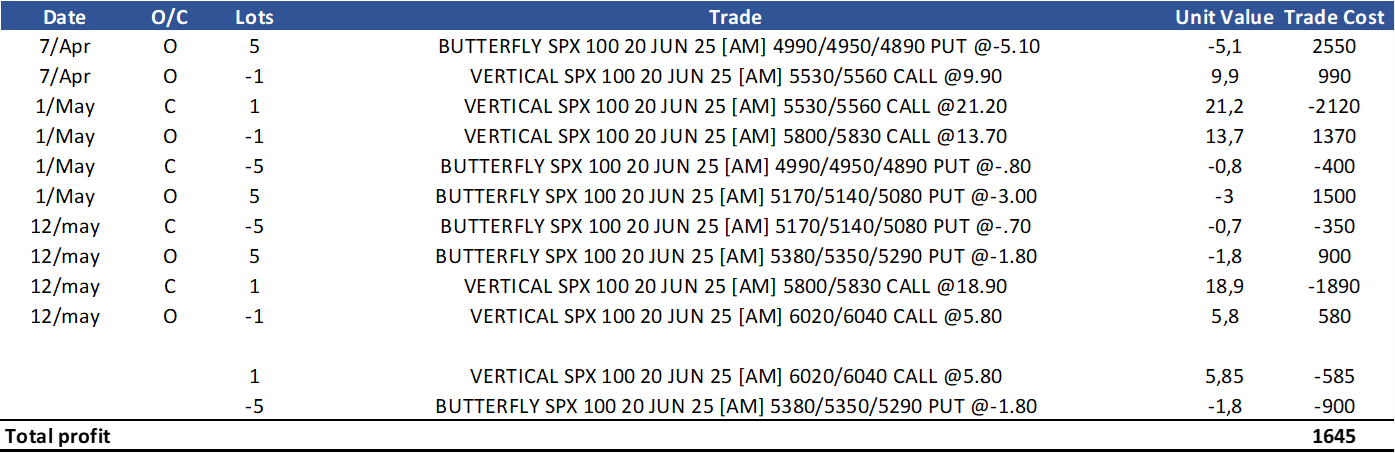

Trade Rationale: Adjust 12 May

With the SPX jumping 3%, its price moved above the "soft hedge" short Call and the trade became with negative Delta. I think the market bias is now clearly positive and we need to adjust to deliver a positive Delta. I moved the whole structure up and positioned:

The BWB center strikes at 5350, which is below the strong support at 5410. I maintained the upper wing width with 30 strikes. The BWB trade continues with 60/30, capturing additional premium and increasing positive Delta;

I moved up the "soft hedge", but reduced its 30 width to 20. This is because I decided to be a bit aggressive on the short Call positioning, at 6020. This is circa 30 Delta and above a strong resistance at 6000.

After the adjustments, the trade shows a flatter t0 line in the SPX price region. The trade is now having +1 Deltas. The trade improved its unrealised profit to $1600 due to a decrease in IV.

Position status:

The trade improved its unrealized profit

Profit target:

Let's reduce the PT to $3000

-----------------------------------

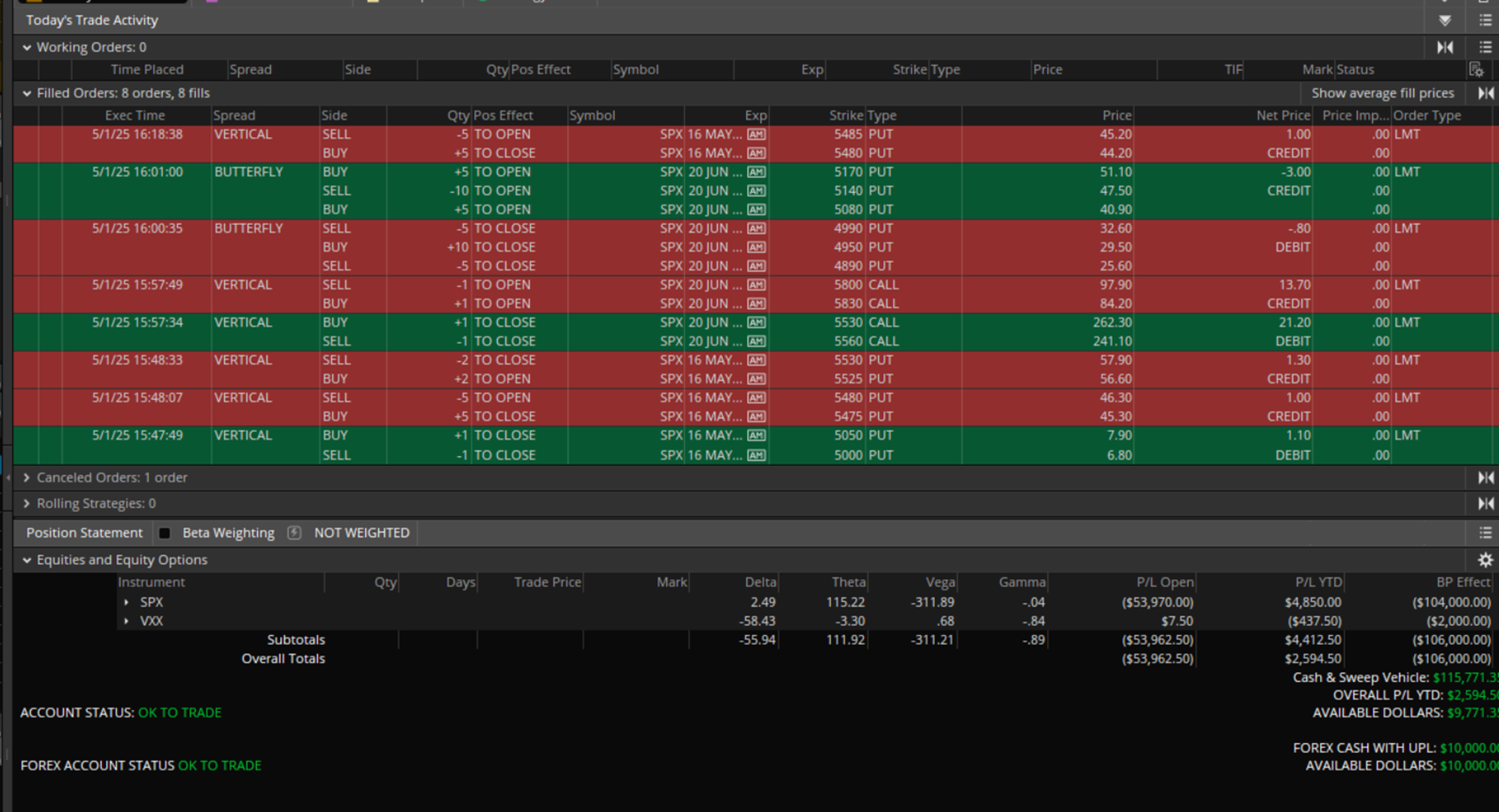

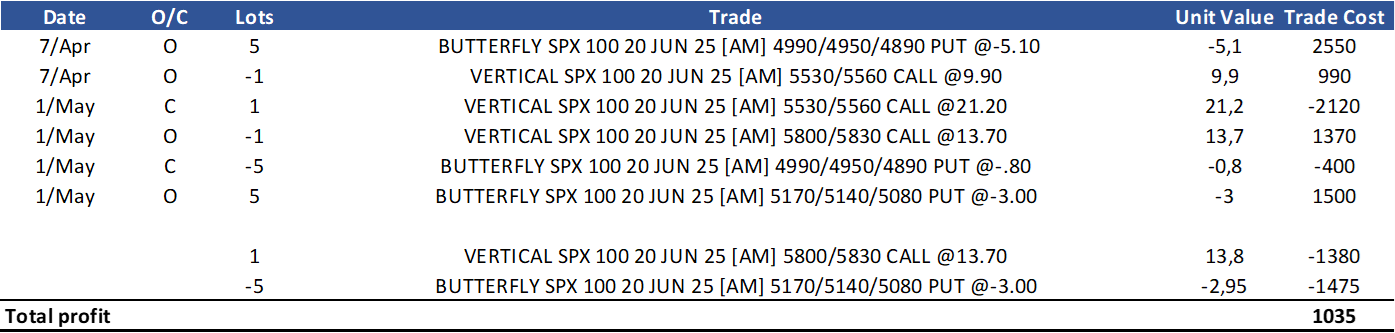

Trade Rationale: Adjust 1 May

With the SPX price moving above the "soft hedge" boundaries and delivering the trade with negative Delta (-1.5), it was time to adjust. I moved the whole structure up and positioned:

The BWB center strike at 5140, which is below the strong support at 5180 - but there are many strong supports below reaching that level. I also decreased the upper wing width from 40 strikes to 30. This will capture additional premium and increase Delta;

I moved up the "soft hedge, maintaining the 30 width strikes. I positioned the short strike at 5800, above the strong resistance at 5780.

After the adjsutments, the trade shows a flat t0 line in the SPX price region. The trade is doing very well at the moment (unrealised profit of $1000) due to decrease in IV since it was opened as well as positive Delta.

Position status:

The trade is now showing a profit of $1000

Profit target:

Let's increase the PT to $4000

---------------------------------------------

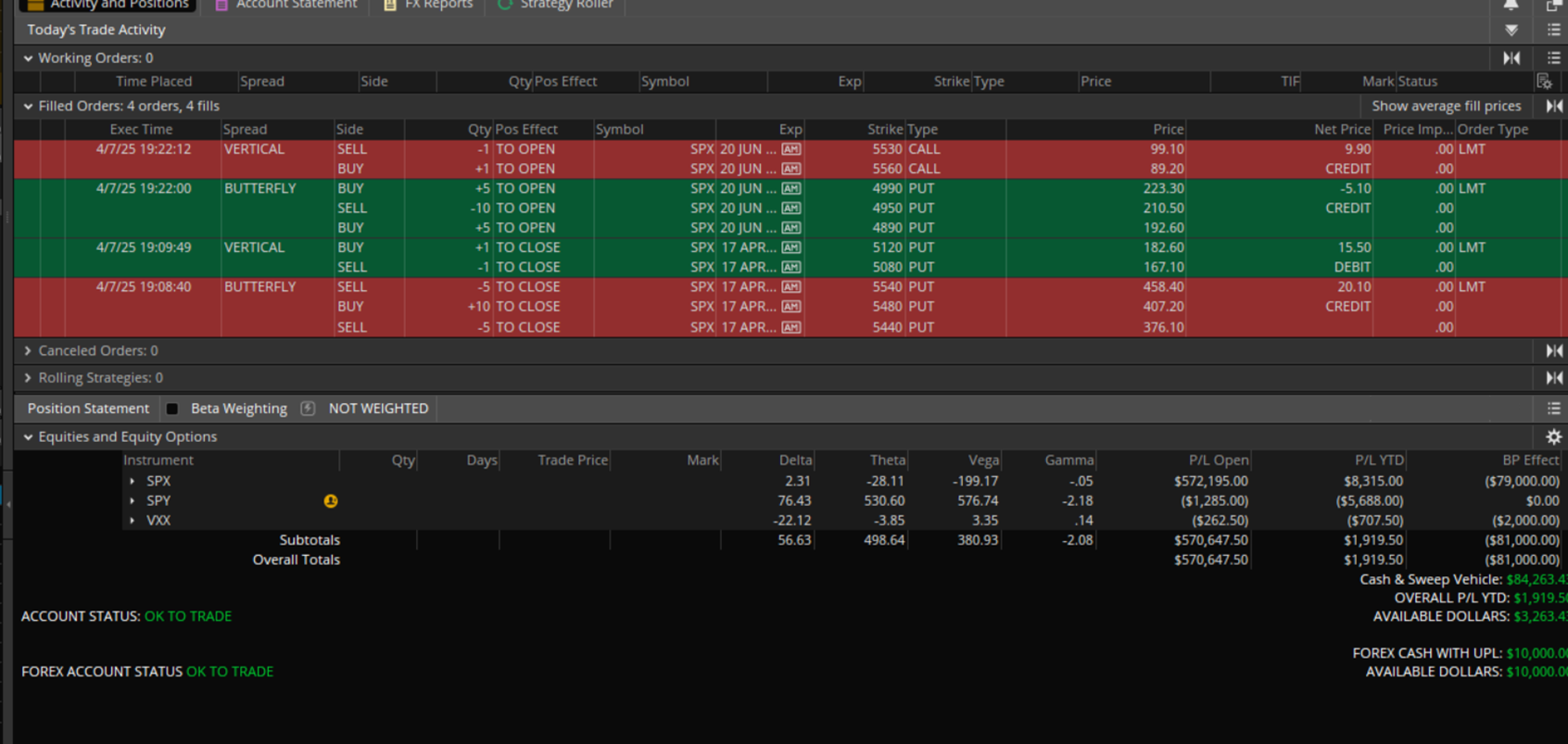

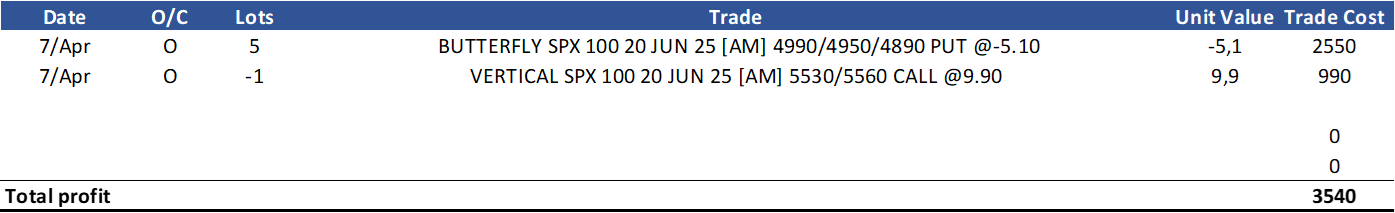

Trade Rationale: Open 7 Apr

After closing the 17APR, I opened this one with the free-up funds. This will decrease overall portfolio risk because Gamma is much lower on this trade due to longer-dated options (vs 17APR). This trade is also producing an big credit due to the very big IV environment. I am also being a bit aggressive on the positioning of the BWB - short strikes are at 4950 (a bit lower than SPX price at the moment - roughly 5050). The other 2 open SPX Best Trades are inverted and delivering negative Delta - this one delivers positive Delta. I think the market should recover from the big correction due to the tariffs. The trade at open has a +2 Delta having the "soft hedge" with a 20 wide spread that adds some negative Delta to the trade. I positioned its short Call at about 30 Delta strike - a bit aggressive also. Today, this trade has 73 days to expiration (DTE) options.

Position status:

The trade entry produced a credit of $3540

Profit target:

Let's assume a PT of $3000