Options Trading Community

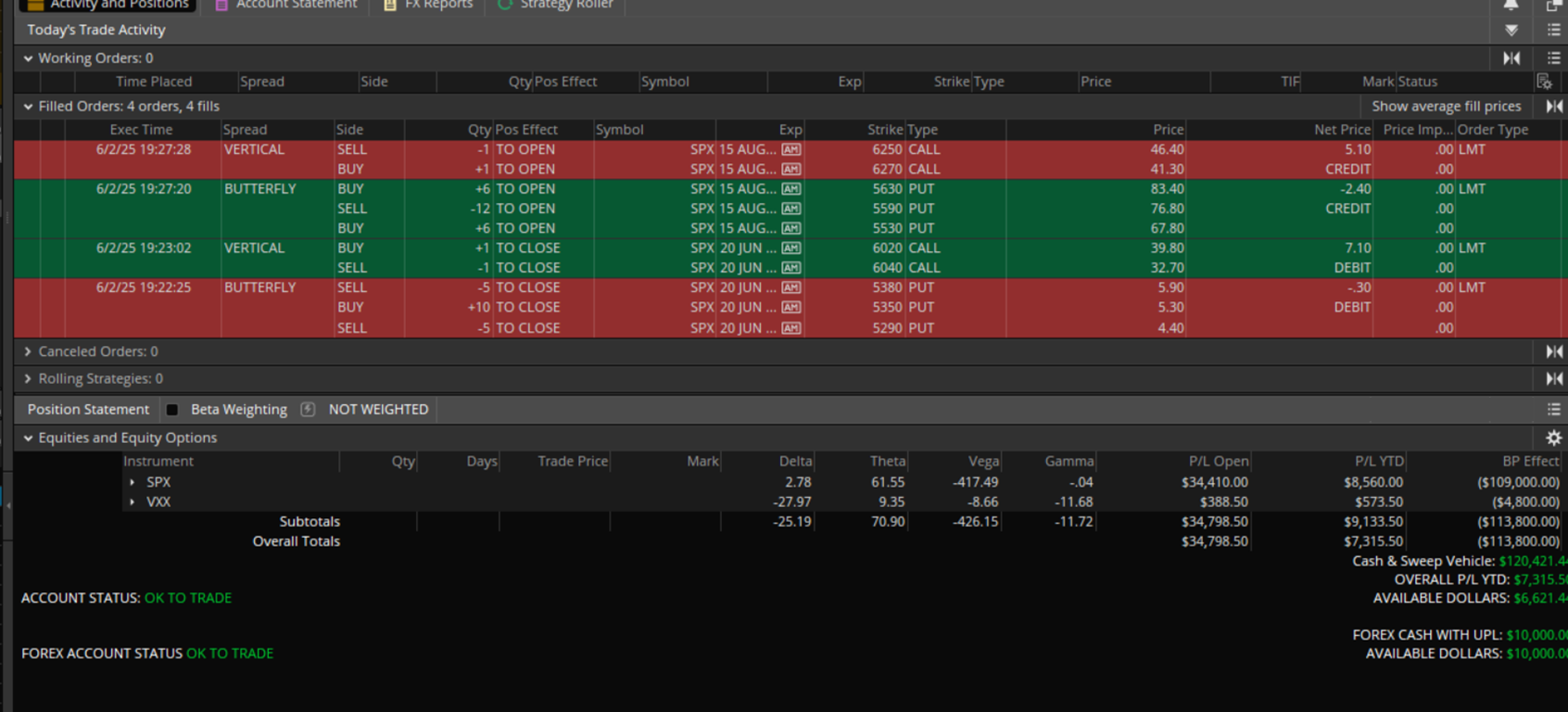

CLOSE: SPX Best 20JUN - Take record profits!

Trade Rationale: Close 2 Jun

With the trade at a record high, trade becoming Delta negative, and SPX continuing to recover, I preferred to close the trade and take the big profit. Then, like always, I will use the free-up funds to open another SPX best Trade far out in time to reduce the overall portfolio risk.

Although there was a big Theta (and increasing), we reached 17DTE, which also brings higher Gamma... no free lunches and it is better to reduce risk and take profits; not being too greedy!

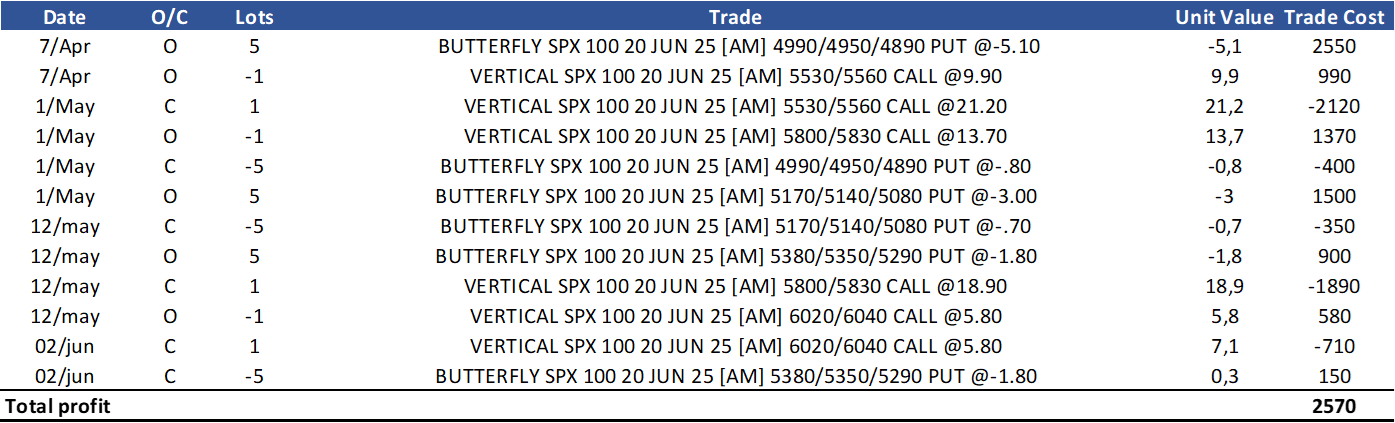

Position finale:

The trade delivered a record profit

-------------------------------------

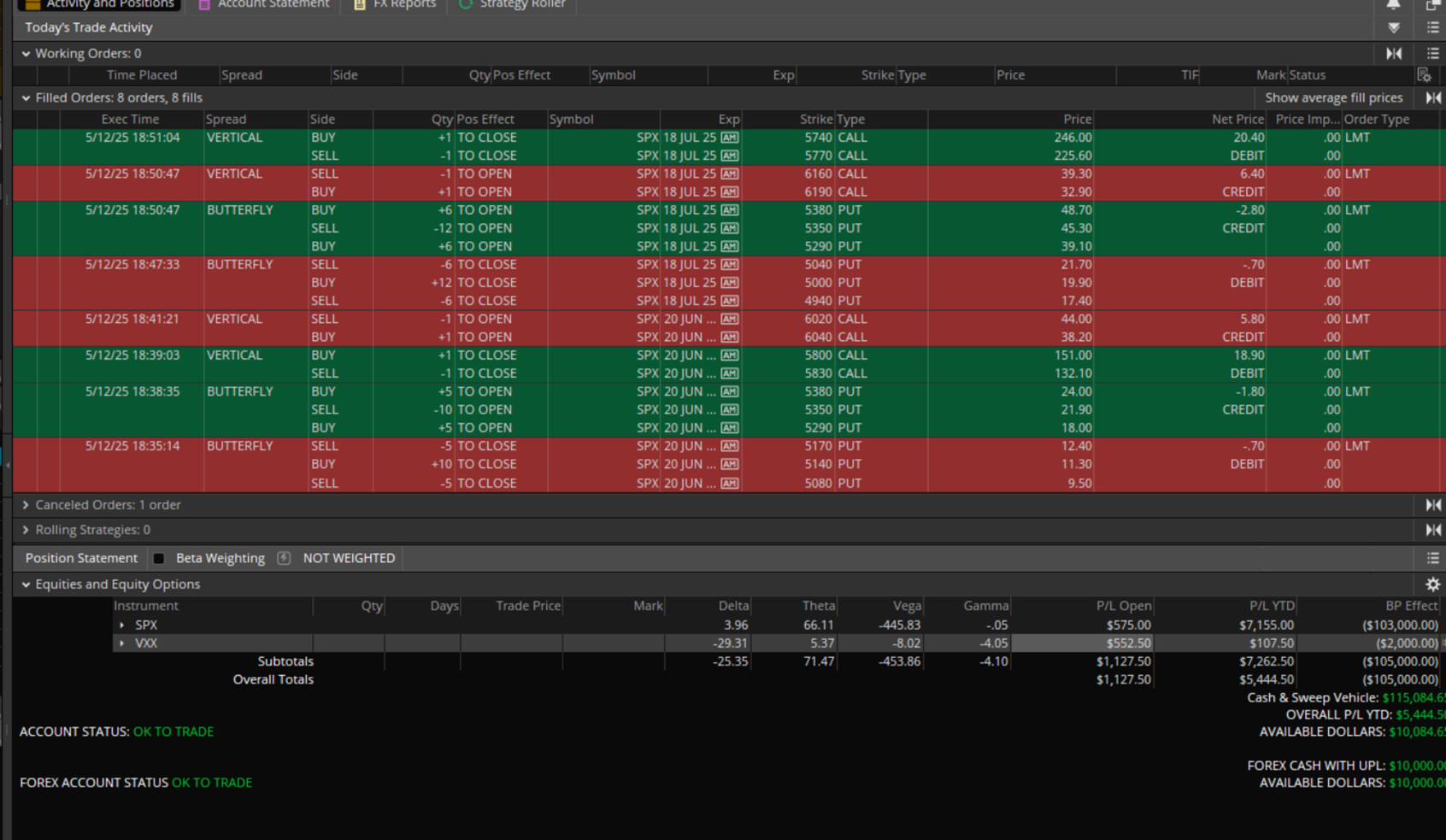

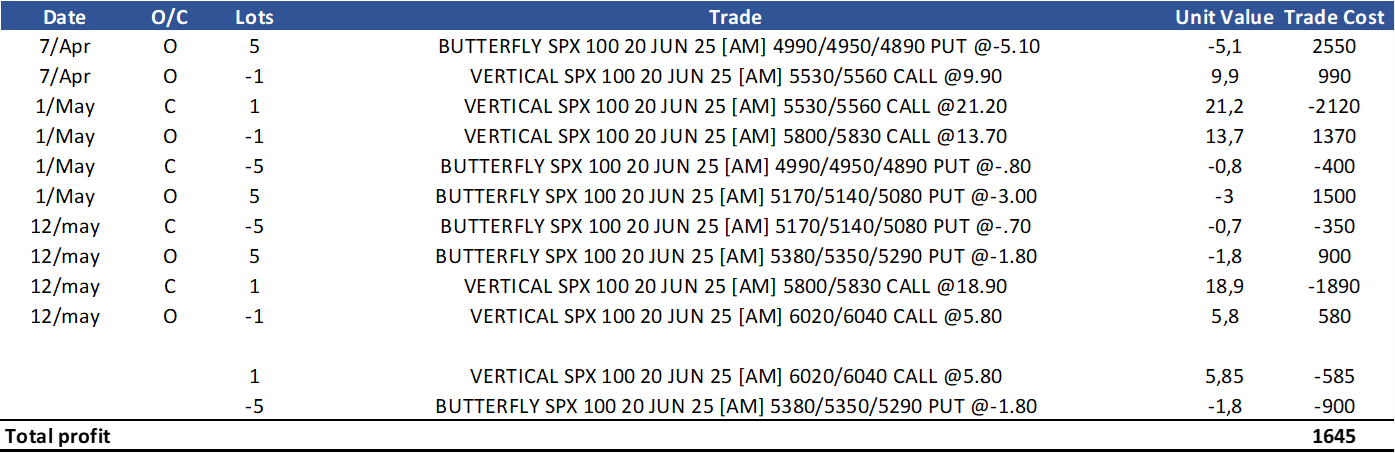

Trade Rationale: Adjust 12 May

With the SPX jumping 3%, its price moved above the "soft hedge" short Call and the trade became with negative Delta. I think the market bias is now clearly positive and we need to adjust to deliver a positive Delta. I moved the whole structure up and positioned:

The BWB center strikes at 5350, which is below the strong support at 5410. I maintained the upper wing width with 30 strikes. The BWB trade continues with 60/30, capturing additional premium and increasing positive Delta;

I moved up the "soft hedge", but reduced its 30 width to 20. This is because I decided to be a bit aggressive on the short Call positioning, at 6020. This is circa 30 Delta and above a strong resistance at 6000.

After the adjustments, the trade shows a flatter t0 line in the SPX price region. The trade is now having +1 Deltas. The trade improved its unrealised profit to $1600 due to a decrease in IV.

Position status:

The trade improved its unrealized profit

Profit target:

Let's reduce the PT to $3000

-----------------------------------

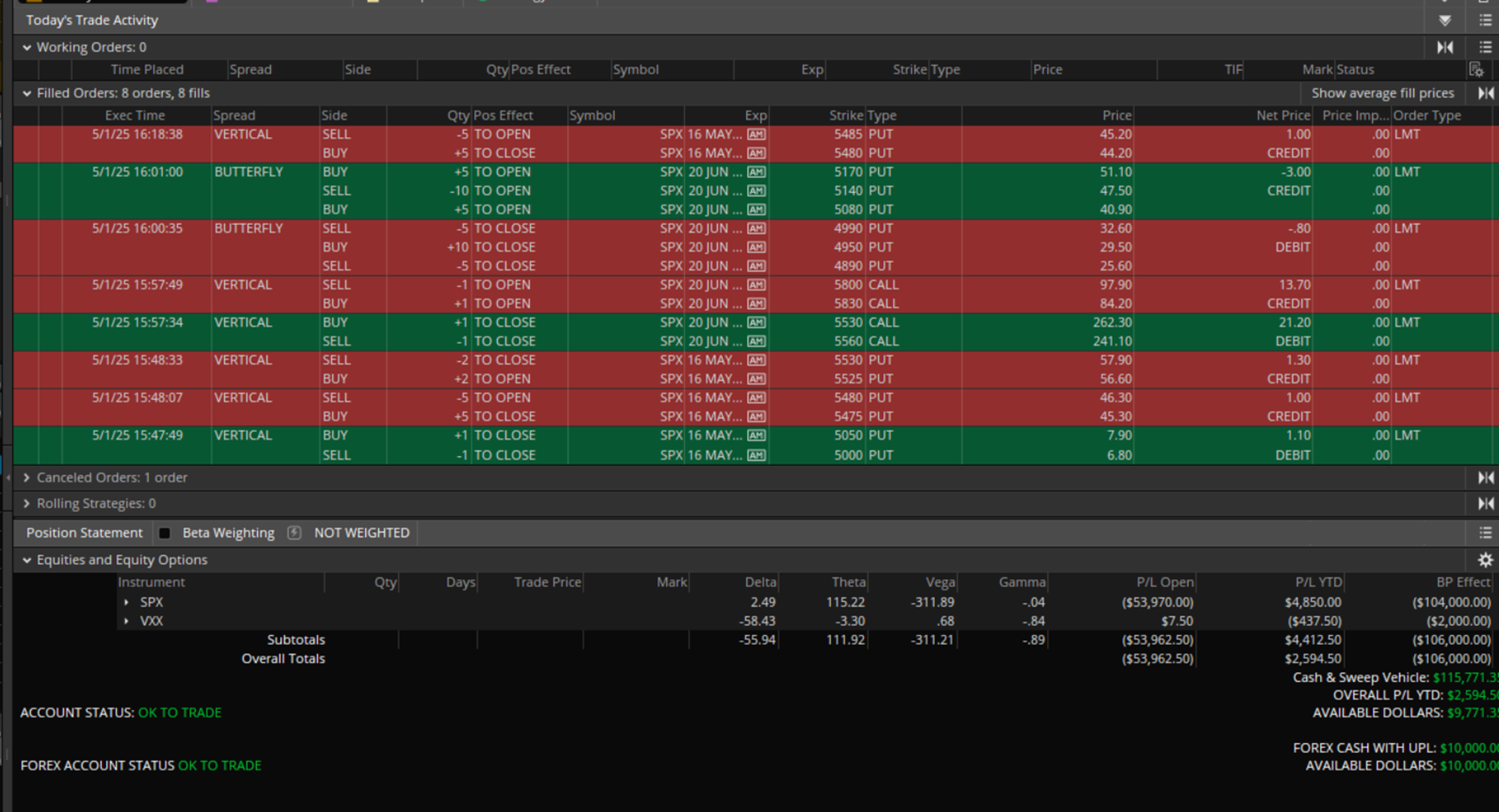

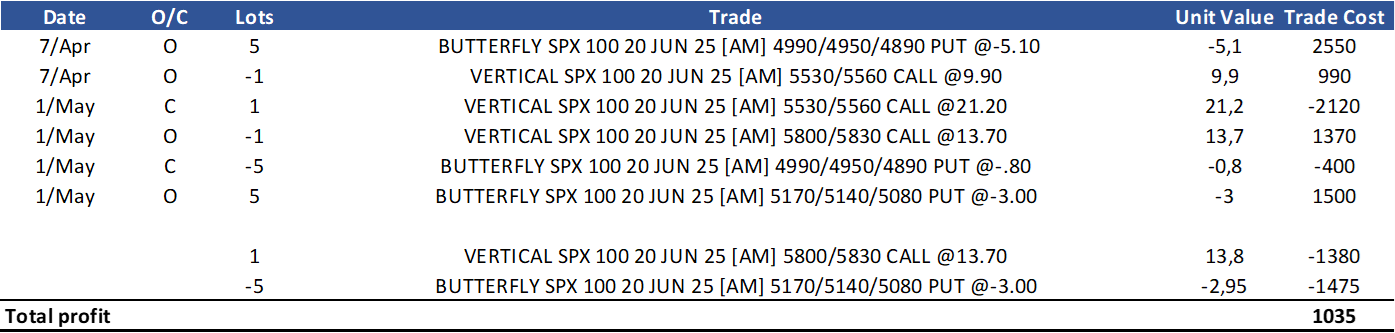

Trade Rationale: Adjust 1 May

With the SPX price moving above the "soft hedge" boundaries and delivering the trade with negative Delta (-1.5), it was time to adjust. I moved the whole structure up and positioned:

The BWB center strike at 5140, which is below the strong support at 5180 - but there are many strong supports below reaching that level. I also decreased the upper wing width from 40 strikes to 30. This will capture additional premium and increase Delta;

I moved up the "soft hedge, maintaining the 30 width strikes. I positioned the short strike at 5800, above the strong resistance at 5780.

After the adjsutments, the trade shows a flat t0 line in the SPX price region. The trade is doing very well at the moment (unrealised profit of $1000) due to decrease in IV since it was opened as well as positive Delta.

Position status:

The trade is now showing a profit of $1000

Profit target:

Let's increase the PT to $4000

---------------------------------------------

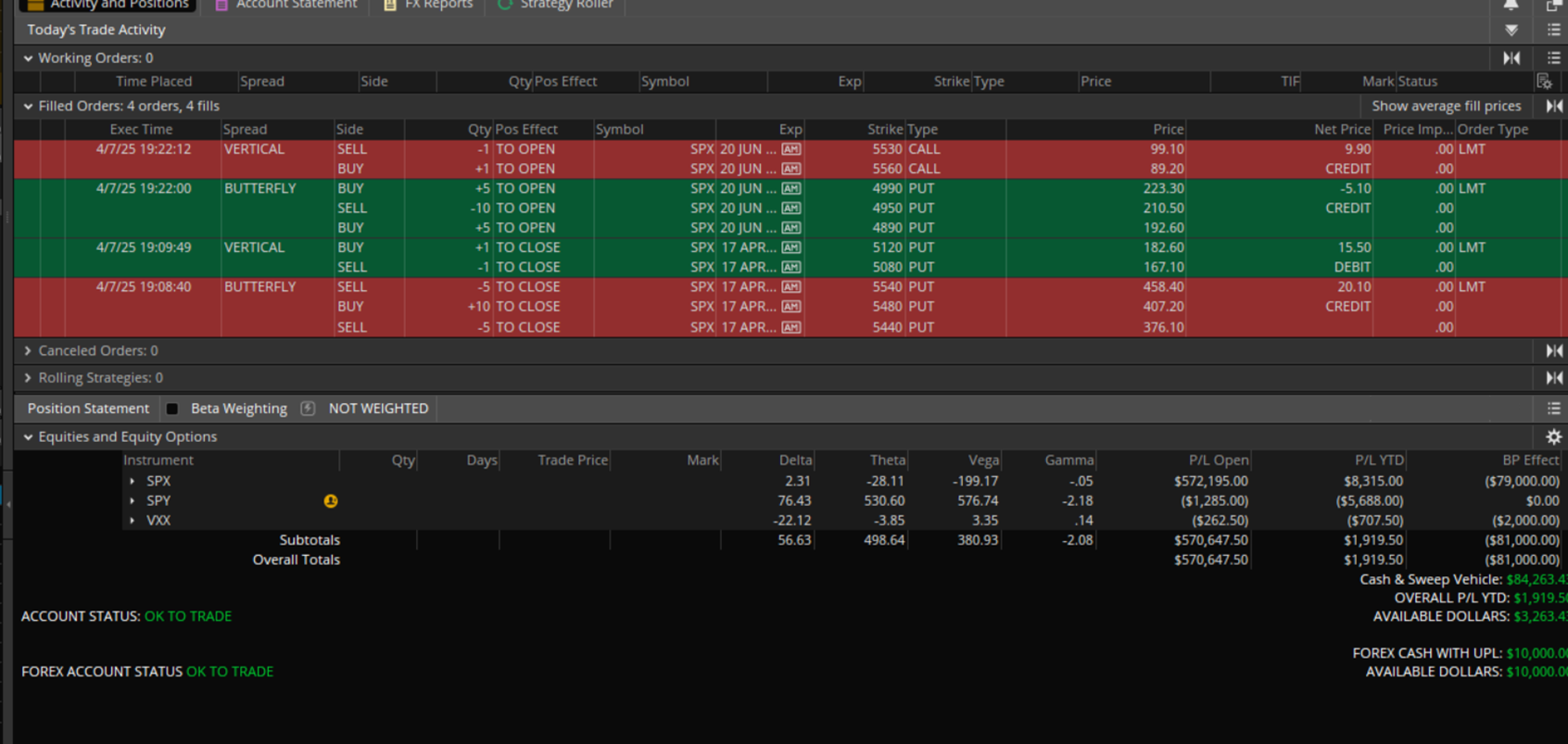

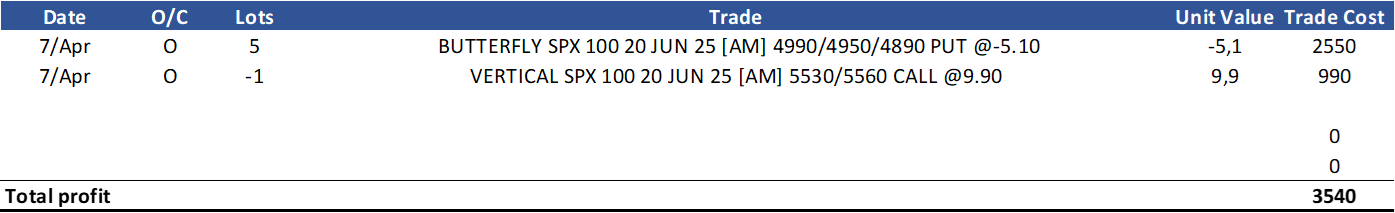

Trade Rationale: Open 7 Apr

After closing the 17APR, I opened this one with the free-up funds. This will decrease overall portfolio risk because Gamma is much lower on this trade due to longer-dated options (vs 17APR). This trade is also producing an big credit due to the very big IV environment. I am also being a bit aggressive on the positioning of the BWB - short strikes are at 4950 (a bit lower than SPX price at the moment - roughly 5050). The other 2 open SPX Best Trades are inverted and delivering negative Delta - this one delivers positive Delta. I think the market should recover from the big correction due to the tariffs. The trade at open has a +2 Delta having the "soft hedge" with a 20 wide spread that adds some negative Delta to the trade. I positioned its short Call at about 30 Delta strike - a bit aggressive also. Today, this trade has 73 days to expiration (DTE) options.

Position status:

The trade entry produced a credit of $3540

Profit target:

Let's assume a PT of $3000

IV Weekly (6JUN): The SPX is Poised for a Move!

A. Market Thesis

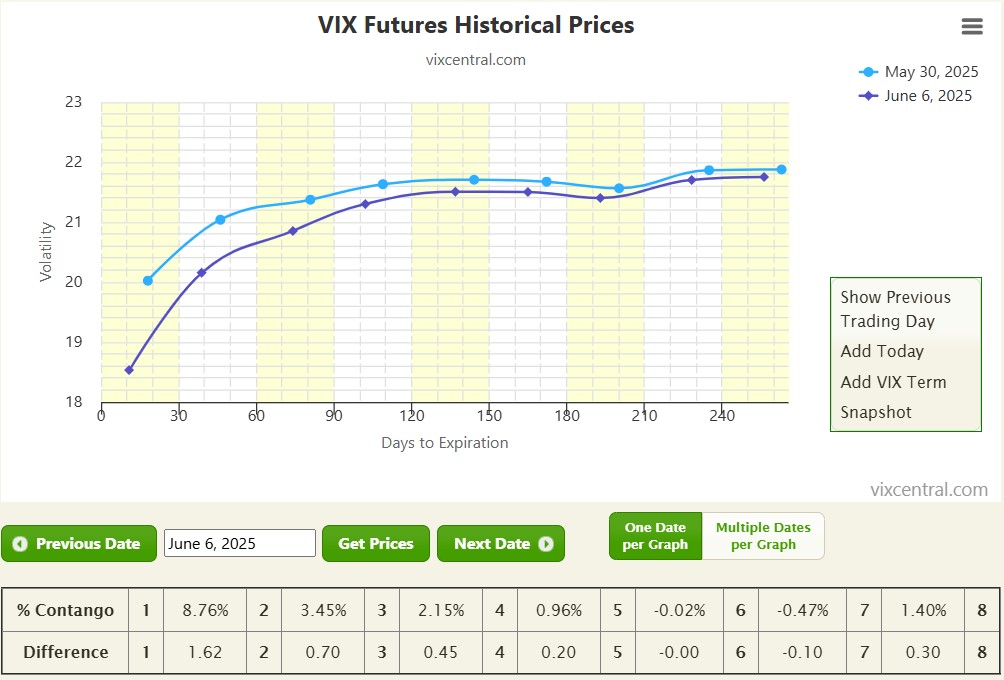

The SPX had a positive week, closing at 6000—up 1.5% from the prior week and registering its second consecutive weekly gain. The positive momentum was supported by a solid May jobs report (139,000 new jobs, 4.2% unemployment) and revived hopes of U.S.–China trade talks. The SPX closed the week under some rejection from the 6010 resistance level. Some hesitation remains for the index to approach all-time highs (6,147). Significantly, this marks a second straight week in the green, reinforcing the ongoing recovery post its April lows. The VIX declined further to close the week at 16.8, marking three consecutive days of drops and underscoring easing market fears. The VIX futures curve continues to steepen into Contango, reflecting growing confidence in a stable volatility outlook.

The market remains at a delicate spot going into next week. My thesis for the coming week builds upon this indecisive yet technically rich environment. The SPX was rejected by the 6010 resistance region, failing to break it, coming from a decreasing IV environment. If there are no surprises from "Mr. T" I think the SPX price should continue higher, breaking up that level. We may see a small technical correction until 5870, but this region should not be broken down. If positive momentum continues, we may see a push toward the 6,140 resistance area (and assist to a new all-time high). This outcome remains favorable for our open SPX Best Trades, as all current BWB positions remain well-positioned in terms of distance to SPX price.

The Volatility Indicator is GREEN

B. S&P Quantum Research

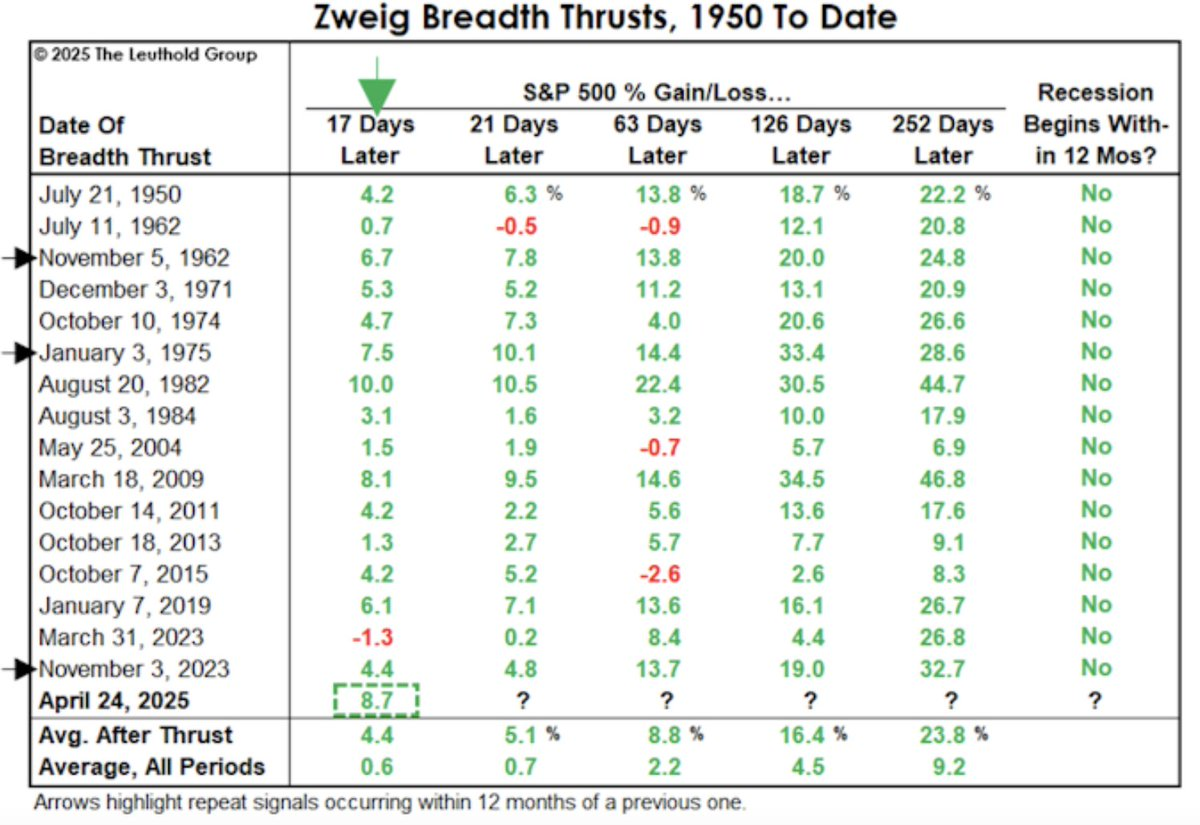

At 17 days since the Zweig Breadth Thrust triggered (Apr. 24th). The S&P 500 had gained +8.7%. This was the second biggest post-Thrust rally of all ZBTs. In 1982 the S&P 500 gained +10% and the forward 12-month gain = +44.7%. In 2009 the S&P 500 gained +8.1% and the forward 12-month gain = +46.8%. There were NO RECESSIONS THAT BEGAN WITHIN 12 months of any ZBT either way and as the table below outlines:

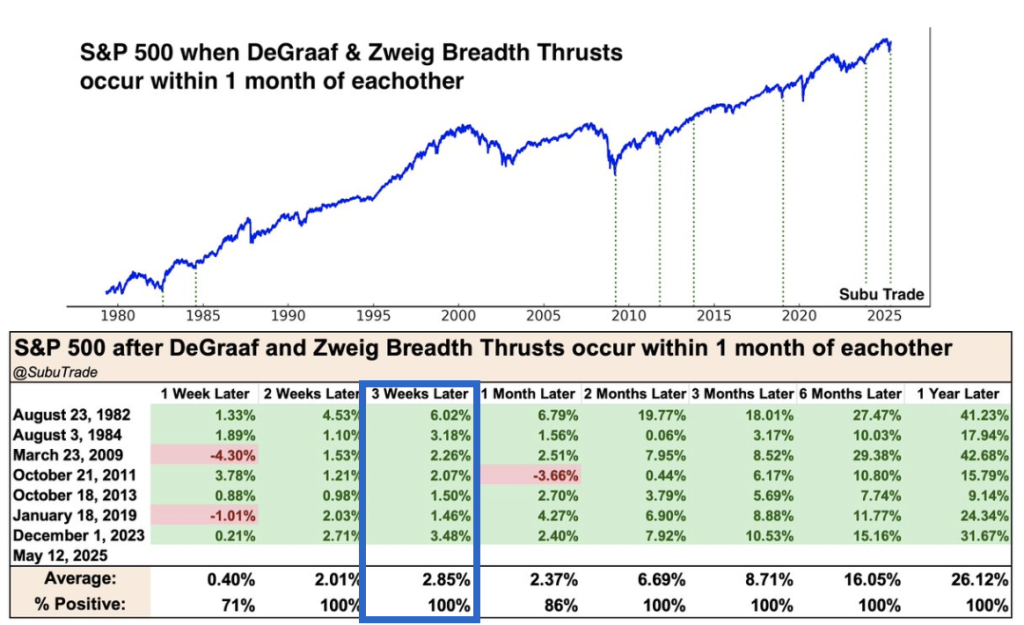

As of May 12, 2025, both a deGraaf and Zweig Breadth Thrust were triggered during the market recovery cycle. Three weeks from the signal date, markets were higher than the signal date price on the rare occurrence. The study remained perfect because the S&P 500 hold above 5,844 past Tuesday.

C. Market Resume

Note: The color Square below check the market conditions to open the 15 SPY Put Spread: GREEN means conditions to open trades are met; RED means conditions are NOT met!

SPX Technical Analysis:

1. Under this high IV, key zones near the SPX price have less relevance:

Resistance at 6010

Next Support at 5870

2. The SPX is under positive bias

3. The VIX futures structure is moved down in all expirations, and Contango is seen in the 4 front expirations. The 2 front months show a high Contango level at 8.7%. This is a sign that the market is calming down and an up slope curve is being observed. The spot VIX closed at 16.8, lower than past week. The Roll Yield continues negative (ratio of spot VIX / front month future), showing improvement also towards market normalization.

D. Hedge Fund Performance

NetLiq: $59006 (YTD 12.6%) / % Invested: 81% ( +194% since Jan 21)

SPX: 6000 (YTD +2.0%) (+25% since Jan 21)

The Fund continued to move up and reached a new record high. Like in last week, this was mainly due to the positive Delta impact of the portfolio, IV move down and some also due to options time decay - especially from the 20JUN SPX Best Trade. This trade was closed for a record profit for this strategy at circa $2500. The remaining SPX Best Trades are good to go and show attractive unrealized profit. The VXX Short Call Vertical was also closed this past week at a nice profit ($450) where it also benefited from both IV reduction and options time decay. We continue to wait for better days to open 15 SPY Put Spreads. In summary, a great week of trading with 2 trades closed for big profits!

At the moment, the Investment Fund has the following positions open:

-

a. 6x 18JUL - "soft hedged" with unbalanced Butterfly (30/60)

b. 5x 31JUL - "soft hedged" with unbalanced Butterfly (30/60)

c. 6x 15AGO - "soft hedged" with unbalanced Butterfly (40/60)

-

a. No Trades

-

a. No trades

discord

Hi, I'm a newbie from Italy. I wanted to know how to access the discord community. Thank you

Which strategy should I begin with?

Hi,

I have only recently started trading options. Simple cash covered puts and credit spreads. I'm looking to widen my knowledge and have a more systematic approach. How should I best leverage your platform? Should I purchase one of your strategies, master it then move on to the next one? If so, which strategy should I begin with i.e. which is your "flagship" strategy? Thanks!

Dave

Hi Dave, thanks for asking. Since you have already basic knowledge, my suggestion is you to join our Trading Community. This will give you access to our Discord channel where you can interact with me and other traders. We are trading mainly the SPX Best trade, SPY Ride and recently the 15 SPY Put Vertical spread. If you want to improve your knowledge and trade with us a more professional strategy, it would be good if you could buy the SPX Best. We are trading this strategy every month (3 open trades at each time) and you will better understand what we are doing. If not you are just following our trades and not learning effectively. Hope that you will join and start trading with us. Cheers, Pedro

CLOSE: SPX Speed Trade, above Profit Target

Trade Rationale: 29 Dec (Close)

As posted yesterday, I wanted to close this trade and capture profits as soon as the market opened. After less than an hour after opening, the Profit Target was reached and I entered the orders to close the trade and capture the profits. In fact, I could have waited some more time in the trading session to close, but it would better not to be too greedy. It was a great trade, in fact: 12.5% in 3 days! What can we ask more?

Position finale:

The trade produced $210 or 12.5% in 3 days!

----------------------------------

Trade Rationale: 28 Dec (Adjust 2)

SPX is moving continued to move down (about 0,90% at the time of entry) and the Delta of the trade was again about 5. So, I added another Vertical to "diagonalise" the trade and keep Delta under control. Theta continues massive!

Position status:

The trade is positive.

Profit target:

Let's assume a PT of $150 or circa 10%

-----------------------------

Trade Rationale: 28 Dec (Adjust)

SPX is moving down (about 0,50% at the time of entry) and the Delta of the trade was reaching about 5. I decided to change one of the 3 lots into a Diagonal to reduce the positive Delta to 2. Theta is massive and is about 800... Let's continue to monitor Delta closely in order to maintain it under control (-5 to 5 is ok). In case the market continues to move down, I will adjust another lot (another Diagonal).

Position status:

The trade is now positive.

Profit target:

Let's assume a PT of $150 or circa 10%

--------------------------

Trade Rationale: 27 Dec (Open)

For a long time, I did not open this type of trade. Today I took this decision because I feel the market is slow due to "vacations" period. The expirations in this Speed Trade are very aggressive. The front-month is on 30th Dec, which is next Friday (3 DTE)... and the back month is 3 Jan (7 DTE). This pair presents an attractive IV structure as the front option is at 19% and the back option is 15%, turning this trade cheaper. Tomorrow, I am expecting to close this trade and collect some profits... remember this is a very aggressive trade!

This trade is producing a huge amount of Theta... for the 3 lots opened, it delivers more than 600.

Position status:

The total investment for the 3 lots is $1680.

Profit target:

Let's assume a PT of $150

CLOSE: SPX Best November

Trade Rationale: Close 17 Nov

With 0 DTE (tomorrow morning, the Nov, 18th these options expire - these are "AM"). The trade was on spot. As I told you yesterday, I flatten the t0 line and widened the max profit area. With SPX moving down we reached the sweet spot of the trade with huge Theta... the Condor gained today about $700... I decided to close and keep the huge profits produced! A total of $1855.

The Investment Fund increased heavily its value!

----------------------------------------

Trade Rationale: Adjust 16 Nov

At 2 DTE we collected strong profits today due to high Theta and negative Delta (for which SPX helped move down). We already passed the Profit target, but I am willing to have one more day in the trade to capture additional profits from the high time decay rate (or Theta). The adjustments today had the goal of flatten as much as possible the t0 line to offset high Gamma. I have widened the Condor profit area:

1. Moved up the upper leg

2. Reduced the width of the lower leg to reduce the downside risk - in case the market tomorrow would fall sharply (we never know...).

For the more conservative traders, it is better to close the trade...

Position status:

The trade recovered strongly and surpassed the profit target.

Profit target:

No profit target; close as soon as the market moves against us.

------------------------------------------

Trade Rationale: Adjust 15 Nov

We are approaching the expiration date and Theta is highly attractive. On the other hand, Gamma (or rate of variation of Delta is very high). I could have closed this trade and moved ahead with a new SPX Best trade. For the more conservative traders closing this trade was a good decision. I decided to have a higher risk and leave the trade until tomorrow or maybe until Friday, capturing more profits. I feel the market is eager to continue its move down and I decided to remove the soft hedge (Short Call Vertical) to avoid having upside risk. Then, I was looking to the trade and thought to capture additional time decay moving the upper wing to the upside and flattering the t0 line. Additionally, if the market retracts and closes in the range of the Condor, I could capture nice profits... I hope the market does not retract fast below 3900. If so, I will close the trade!

Position status:

The trade is now positive.

Profit target:

Let's maitain the PT to $600.

------------------------------

Trade Rationale: Adjust 11 Nov

Again, today is a positive day for SPX. I decided to move the butterfly structure up to capture a bit more premium and increase Theta. Next week is the expiration week of the Nov options and Theta will increase a lot. And if the SPX price continues above the butterfly structure it will protect in case of a selloff. Meanwhile, the 4000 level is not yet broken. We should monitor closely this trade and capture nice profits from Theta, mainly.

Position status:

The trade is now having a small drawdown.

Profit target:

Let's maitain the PT to $600.

-------------------------------------

Trade Rationale: Adjust 10 Nov

What a day! The SPX is now moving up 5.5%! The SPX price is at the short Call strike and the structure has a negative Delta. I feel the market may retract but it was a value too big (-6 at time of adjustment). After the adjustment where I moved up the soft hedge, the Delta reduced to -3. The SPX continues to move up and at this moment the Delta increased its negative value to -4.8... Tomorrow, I will decide if I close the trade or continue to adjust...

Position status:

The trade increased its value and presents a small profit.

Profit target:

Let's decrease the PT to $600.

-----------------------------------

Trade Rationale: Adjust 1 Nov

The SPX is trying to break the strong resistance at 3900 and is retracting a bit. I feel the market is now calmer and it should not go lower than 3640 until the Nov expiration (18NOV) - the SPX is now in a positive trend. Obviously, we never know... This is my judgment. Since the Butterfly structure was too far down and not contributing too much for the trade, I decided to move it higher (added an additional lot as I had available cash). I chose the 3600 strike price for the short Puts of the new Butterfly because they are below the strong support at 3640.

With this move, I added some positive Delta, increased Theta, and captured additional premium. The Delta ended almost neutral (previously had -2.5). It is expected that the t0 line starts to inflate as we are approaching the expiration deadline turning Delta increasingly negative in case the SPX stays stable.

Position status:

The trade increased its value and is almost at break-even.

Profit target:

Let's increase the PT to $1100.

----------------------------------------------------

Best Volatility Trade at this current vola

Hi guys,

I'm wondering what kind of trades / strategies you are trading at this current vola situation. The Vola is too low to short it but also too high for long trades. Looking forward to get some intersting input :)

Cheers, Marc

At the moment, under the current market environment, we are not trading VXX strategies. The CROC Trade should be the one that will perform best under the high swings of VXX. Or the Black Hole when there is a peak. We are capturing nice profits in the last months with SPX Best strategy. This is doing very well!

Cheers

Pedro

Close: SPX Best (17JUN) - a nice recovery trade!

Trade Rationale: Close 7 Jun

I decided to close this trade, capturing nice profits, despite the big drawdown this trade had a few weeks ago. I am using the free capital to open a new Best Trade for August. Theta was highly attractive and we could let the trade open a few more days; but, the market could move fast to any side and it is better to change this trade with another in a higher timeframe to decrease its Gamma (and Directional) risks.

Final position:

The trade delivered a profit of above $500.

-----------------------------------------

Trade Rationale: Adjust 1 Jun

As the new SPX trade opened (July), I decided to adjust this trade to prevent any potential loss in case the market breaks the strong resistance at the 4150 region. Also this move “softened” the position Delta and now we have a lower risk to the upside. Meanwhile, the trade is recovering from its drawdown and now presents a small profit.

Position status:

The trade is recovering from its drawdown and presents a small profit.

Profit target:

Let's increase the PT to $250.

-----------------------------------

Trade Rationale: Adjust 26 May

The SPX moved up strongly and closed about +2%. During the last trading hours, the Best Trade became with too high negative Delta (circa -5). I decided to be conservative and lower this directional risk and move up the soft hedge (or the sold Put Vertical). I bought back for a profit the Vertical we opened on 12May and open a new one at higher strikes. This adjustment lowered the trade Delta to about -1 and increased its Theta. We are now better protected in case the market continues its move up tomorrow. I think we should continue to be with negative Delta bias in case the SPX does not break the 4100 level.

Position status:

The trade is recovering from its drawdown.

Profit target:

Let's reduce the PT to 0.

---------------------------------------

Trade Rationale: Adjust 12 May

The SPX was most of the day in a strong down move. During this period I decided to add negative Delta to the trade and increase its Theta. I increased the width of the upper butterfly leg to capture more premium. For the last session minutes, the SPX started to recover and I added a short Put Vertical at a lower strong support (3700). This Vertical added a positive Delta, although the total structure trade continued with a small negative Delta. But, it also added additional Theta and capture more premium. I decided to add this Vertical to capture the high premium of this high IV environment. In case the market starts to recover it will deliver fast profits and tend to flatten t0 line.

Position status:

The trade recovered from its drawdown.

Profit target:

Let's reduce the PT to 0.

----------------------------------

Trade Rationale: Adjust 9 May

The SPX Moved again down very fast. This penalized the trade and the total Delta became too positive. Therefore we need to adjust. I decided to remove the upper soft hedge Vertical (keeping its profits) and invert the Butterfly structure to be Delta negative. The market may continue to move down and it is better to have this bias that also protects against IV increases.

Position status:

The trade suffered again.

Profit target:

Let's reduce the PT to 0.

Close: SPY Ride Trade at almost Profit Target

Trade Rationale: Close 28 Oct

We were about to reach the profit target and I decided to close the trade and cash-in some profits. We were about to reach the profit target but I decided to close it and enter a new trade tomorrow or so.

Position status:

The trade was closed in nice profits.

-----------------------------------

Trade Rationale: Adjust 25 Oct

The SPY moved up and the Delta of this trade became too negative - Delta/Theta ratio slightly above 1. Hence, I decided to open a short Put Vertical to have the trade a bit more Delta neutral. I used a short-term expiry to have more Delta impact.

Position status:

The trade is in profit.

Profit target:

Let's continue to assume a profit target of 600$ or 10%.

---------------------------------------

Trade Rationale: Adjust 15 Oct

The SPY continued to move up and touched the upper Calendar strike. Therefore, it is better to implement the Calendar swap (closing the lower strike and opening a new Call Calendar at an upper strike at 30 Delta). I also removed the Short Put Vertical that was producing positive Delta and captured some profits. Additionally, I adjusted the trade structure and Delta with additional Calendars at the former middle (now lower strike).

Position status:

The trade increased profits.

Profit target:

Let's continue to assume a profit target of 600$ or 10%.

----------------------------------

(continue)

Close: SPX Speed Trade at Profit Target (in one day!)

Trade Rationale: 29 Oct (Close)

Profit Target was surpassed. Better close the trade and capture profits...

Final position:

-----------------------------

Trade Rationale: 28 Oct (Open)

I was checking for another trade opportunity after closing both Ride Trades and found this opportunity. The front-month has a higher IV than Back-month. But, there is one big difference between this trade and the traditional Speed Trade. As you can check there is only 3 days difference between both front and back month in this Calendar spread. This type of Calendar has less Vega and there is also reduced risk. The Calendar only costs 3.20 (usually it should cost around 12-16 when entered with at least 10 DTE difference between expirations). Let's see how it goes.

Position status:

Profit target:

Let's assume a PT of $160 or 10%.

Hi, thanks for joining. Under the free membership, you can only access the General Room and interact with members. For the Fund trades, you need to subscribe to one paid membership. Check here: https://www.myoptionsedge.com/learn-from-my-trades

Where can I subscribe to the paid membership?