IV Weekly (6JUN): The SPX is Poised for a Move!

A. Market Thesis

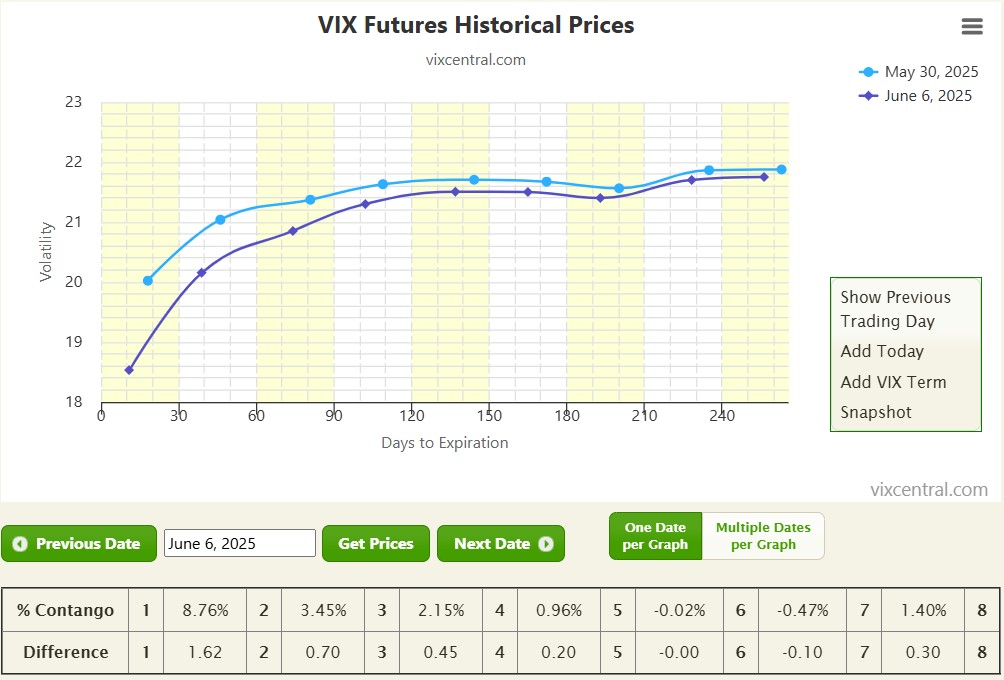

The SPX had a positive week, closing at 6000—up 1.5% from the prior week and registering its second consecutive weekly gain. The positive momentum was supported by a solid May jobs report (139,000 new jobs, 4.2% unemployment) and revived hopes of U.S.–China trade talks. The SPX closed the week under some rejection from the 6010 resistance level. Some hesitation remains for the index to approach all-time highs (6,147). Significantly, this marks a second straight week in the green, reinforcing the ongoing recovery post its April lows. The VIX declined further to close the week at 16.8, marking three consecutive days of drops and underscoring easing market fears. The VIX futures curve continues to steepen into Contango, reflecting growing confidence in a stable volatility outlook.

The market remains at a delicate spot going into next week. My thesis for the coming week builds upon this indecisive yet technically rich environment. The SPX was rejected by the 6010 resistance region, failing to break it, coming from a decreasing IV environment. If there are no surprises from "Mr. T" I think the SPX price should continue higher, breaking up that level. We may see a small technical correction until 5870, but this region should not be broken down. If positive momentum continues, we may see a push toward the 6,140 resistance area (and assist to a new all-time high). This outcome remains favorable for our open SPX Best Trades, as all current BWB positions remain well-positioned in terms of distance to SPX price.

The Volatility Indicator is GREEN

B. S&P Quantum Research

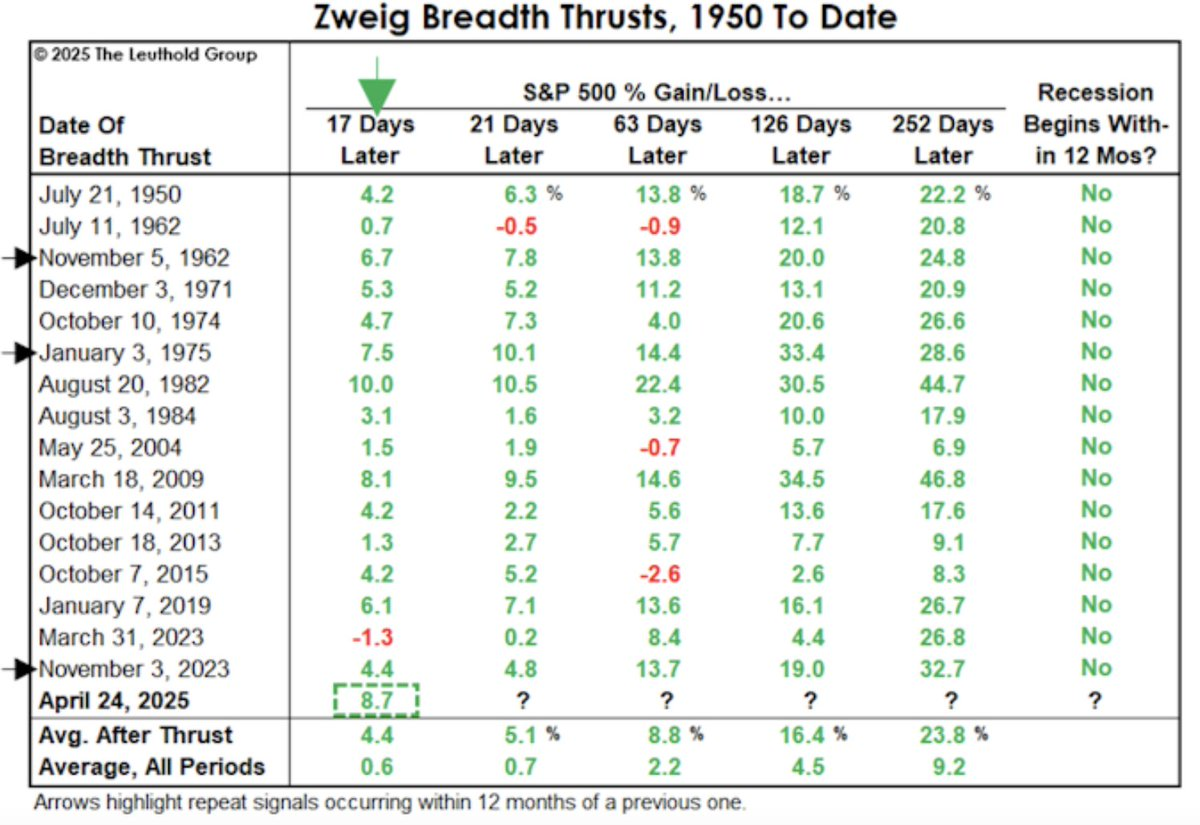

At 17 days since the Zweig Breadth Thrust triggered (Apr. 24th). The S&P 500 had gained +8.7%. This was the second biggest post-Thrust rally of all ZBTs. In 1982 the S&P 500 gained +10% and the forward 12-month gain = +44.7%. In 2009 the S&P 500 gained +8.1% and the forward 12-month gain = +46.8%. There were NO RECESSIONS THAT BEGAN WITHIN 12 months of any ZBT either way and as the table below outlines:

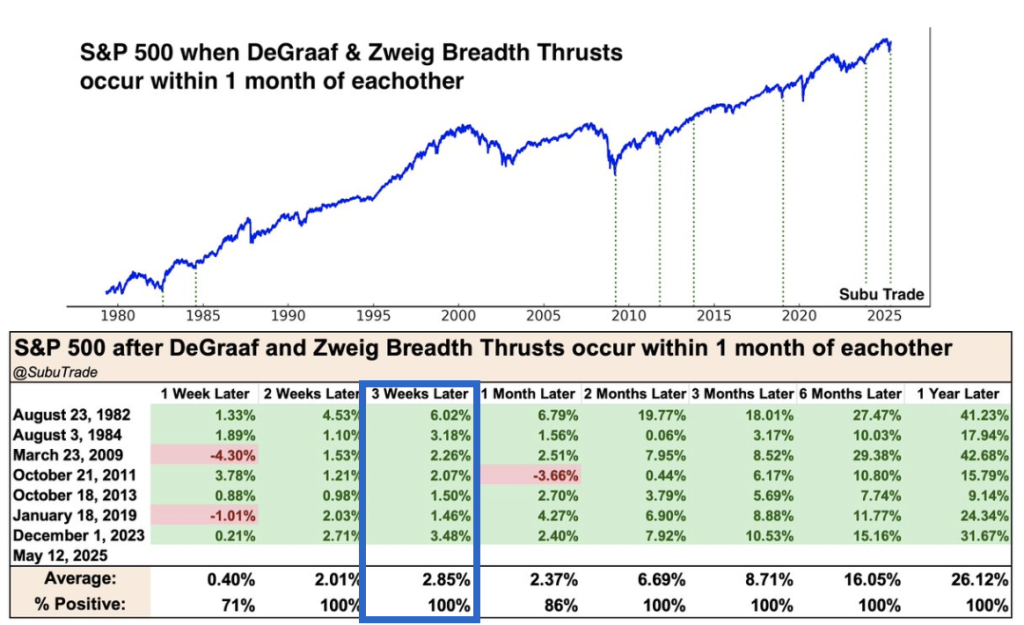

As of May 12, 2025, both a deGraaf and Zweig Breadth Thrust were triggered during the market recovery cycle. Three weeks from the signal date, markets were higher than the signal date price on the rare occurrence. The study remained perfect because the S&P 500 hold above 5,844 past Tuesday.

C. Market Resume

Note: The color Square below check the market conditions to open the 15 SPY Put Spread: GREEN means conditions to open trades are met; RED means conditions are NOT met!

SPX Technical Analysis:

1. Under this high IV, key zones near the SPX price have less relevance:

Resistance at 6010

Next Support at 5870

2. The SPX is under positive bias

3. The VIX futures structure is moved down in all expirations, and Contango is seen in the 4 front expirations. The 2 front months show a high Contango level at 8.7%. This is a sign that the market is calming down and an up slope curve is being observed. The spot VIX closed at 16.8, lower than past week. The Roll Yield continues negative (ratio of spot VIX / front month future), showing improvement also towards market normalization.

D. Hedge Fund Performance

NetLiq: $59006 (YTD 12.6%) / % Invested: 81% ( +194% since Jan 21)

SPX: 6000 (YTD +2.0%) (+25% since Jan 21)

The Fund continued to move up and reached a new record high. Like in last week, this was mainly due to the positive Delta impact of the portfolio, IV move down and some also due to options time decay - especially from the 20JUN SPX Best Trade. This trade was closed for a record profit for this strategy at circa $2500. The remaining SPX Best Trades are good to go and show attractive unrealized profit. The VXX Short Call Vertical was also closed this past week at a nice profit ($450) where it also benefited from both IV reduction and options time decay. We continue to wait for better days to open 15 SPY Put Spreads. In summary, a great week of trading with 2 trades closed for big profits!

At the moment, the Investment Fund has the following positions open:

-

a. 6x 18JUL - "soft hedged" with unbalanced Butterfly (30/60)

b. 5x 31JUL - "soft hedged" with unbalanced Butterfly (30/60)

c. 6x 15AGO - "soft hedged" with unbalanced Butterfly (40/60)

-

a. No Trades

-

a. No trades