Sign up to receive my Weekly Market Thesis that includes Market Research, S&P Quant Data, Promotions and Educational Options tips. Exclusive for subscribers

Trading Account

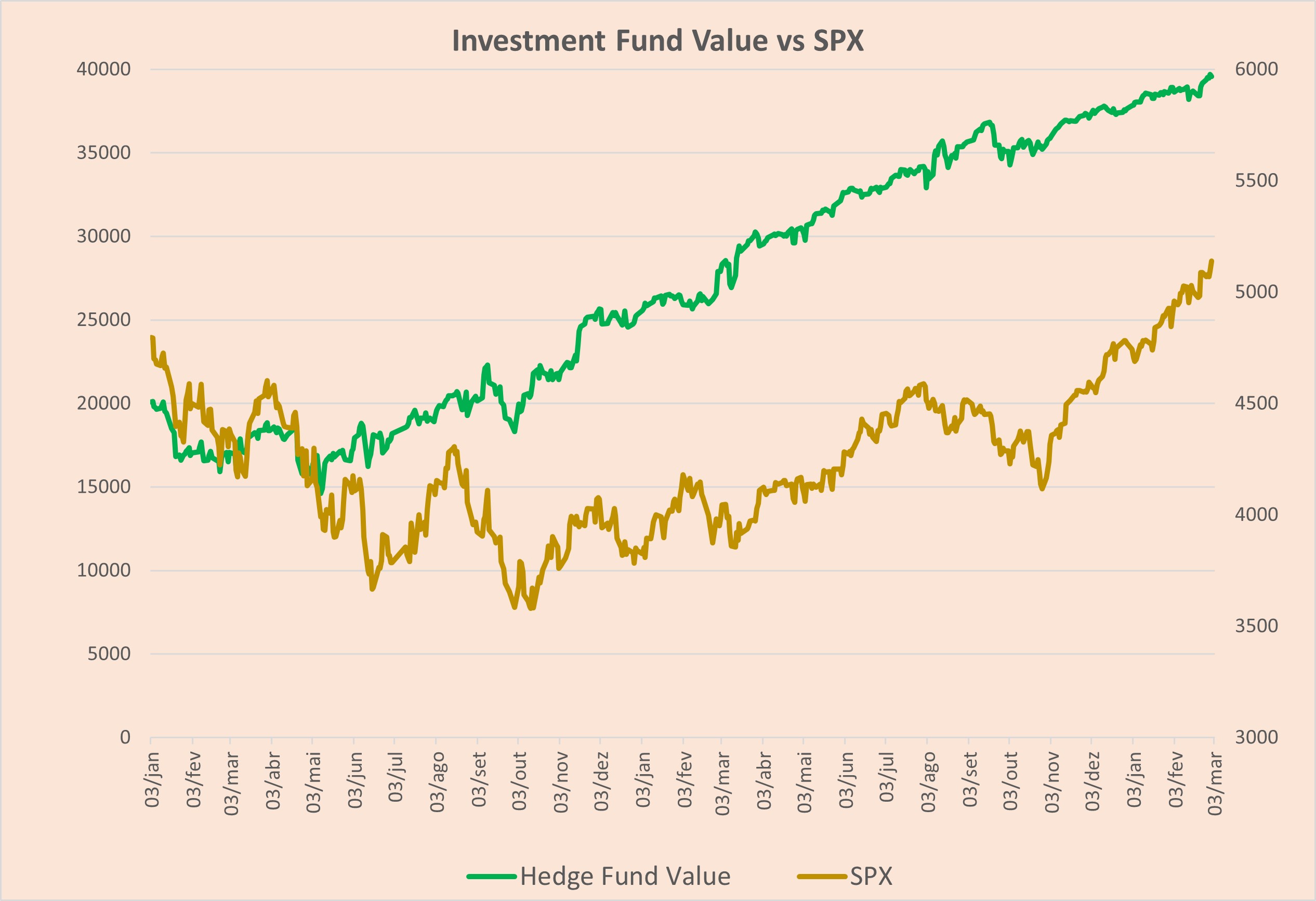

The Fund closed Friday with a strong increase from the past week. This was mainly due to a decrease in IV and our positive Delta bias. The SPX Best trades show unrealized profits and the SPY Ride Trade was closed for higher profit than its profit target. The fund is now +4.0% YTD (vs SPX 0.9%).

Trading Account

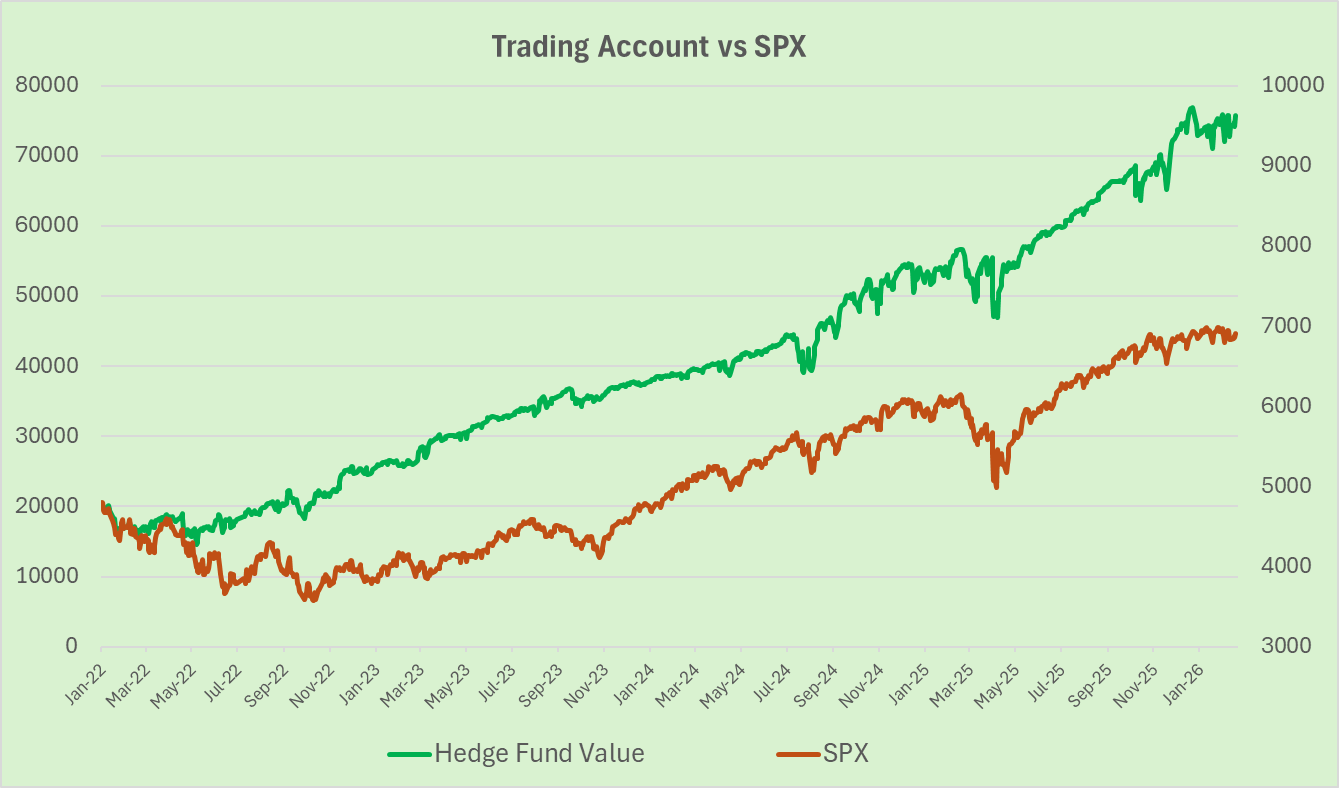

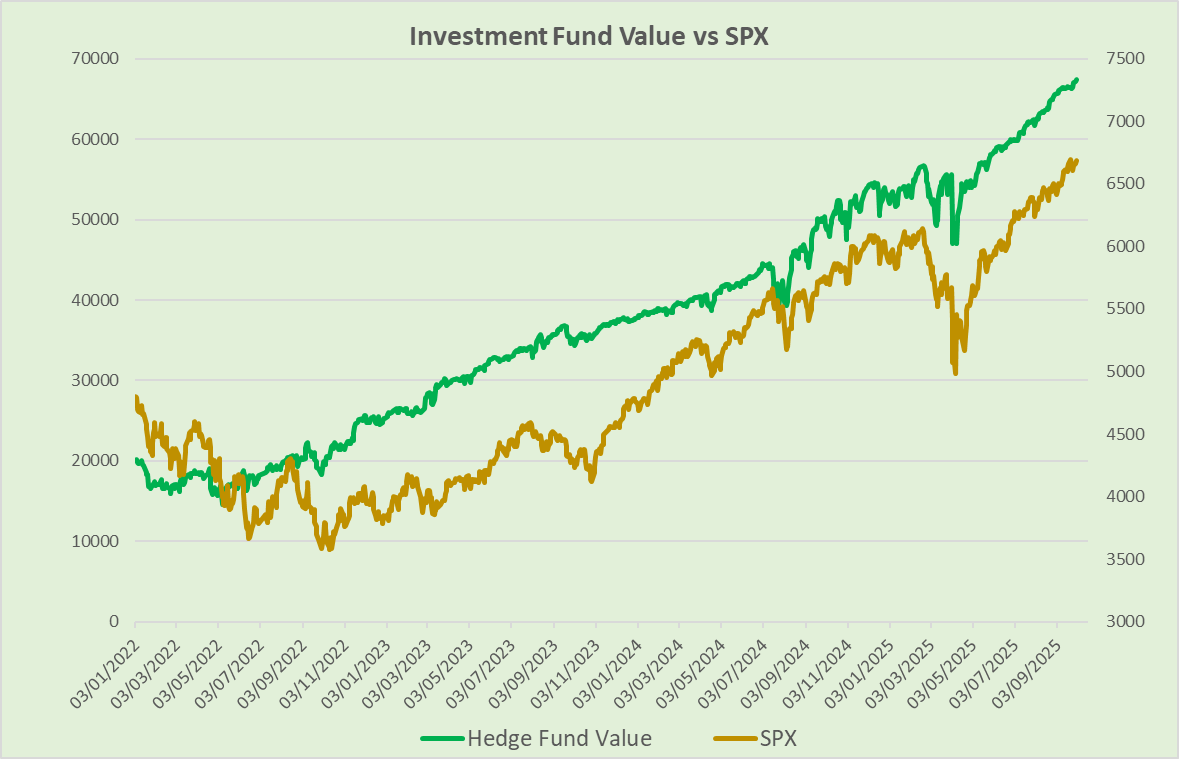

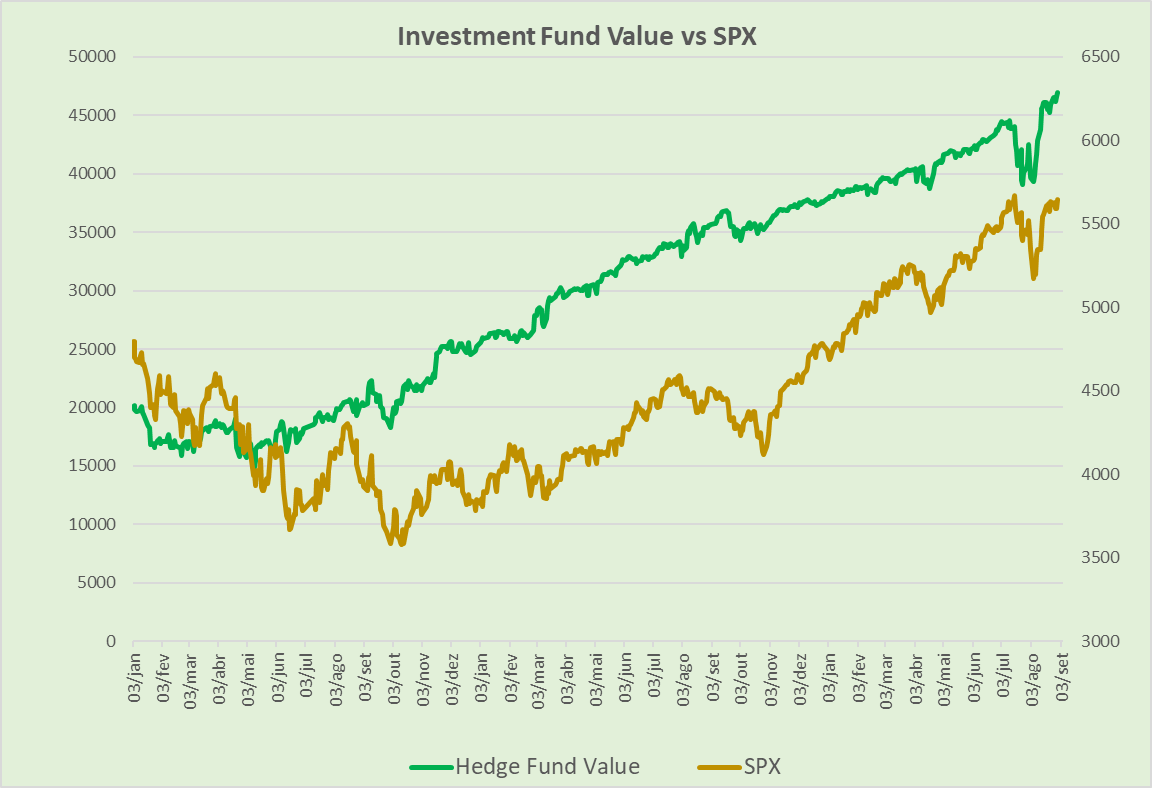

Since Jan22: +271% / SPX: +44%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

.

In January 2026, the S&P 500 index delivered a modest positive return, extending the market’s multi-year rally. Broad market data show the index rose by approximately 1.3% during the month, supported by late-month strength that helped push the S&P 500 toward record highs, including an intraday peak above 7,000 points late in January. However, price action was not without volatility: mid-month geopolitical tensions and tariff concerns sparked a sharp sell-off, including one of the index’s worst trading days in months, driven largely by weakness in megacap technology names.

The VIX briefly spiked above 20 during episodes of geopolitical and tariff-related uncertainty, signaling heightened investor nervousness, but it quickly retreated back into the mid-teens as market stress eased and equities rebounded by month’s end.

During the month, we maintained our +Delta bias of the SPX Best Trades that contributed to the positive return. The VIX closed the month at a low reading (17.4). During the month, we closed one SPX Best Trades for a $1600 profit.

At the end of the month, there were 3 opened SPX Best Trades: 20MAR, 31MAR and 17APR expirations. There is also an open SPY Ride Trade at above profit target.

The Investment Fund closed the month and year with a value of $74.5k (+2.1% YTD) - a gain of circa $1500 for the month. The 50% annual return goal is within our sight and, for the moment, we have succeeded in beating the SPX. The Fund continues to have a target of 50% annual return for 2026.

Trading Account

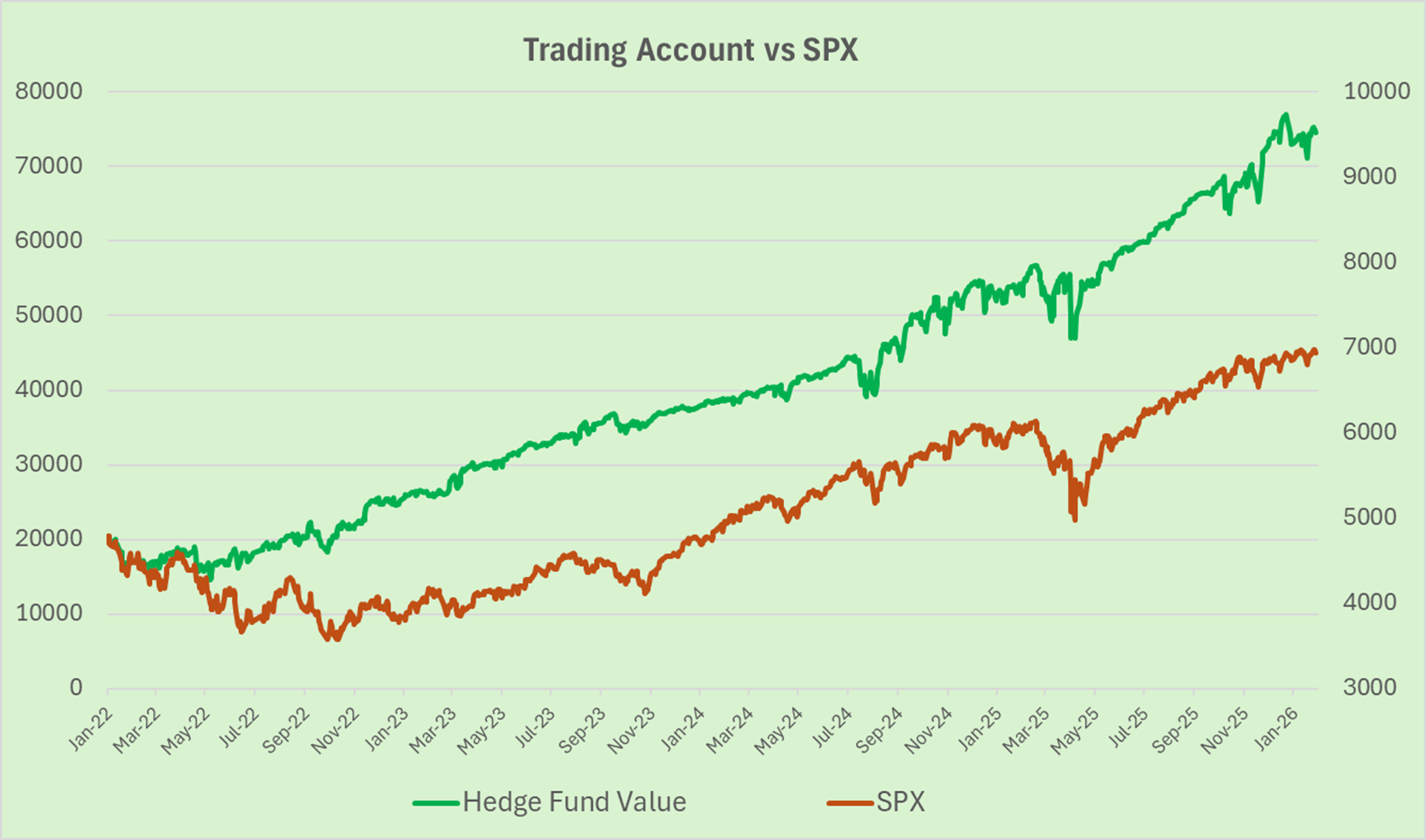

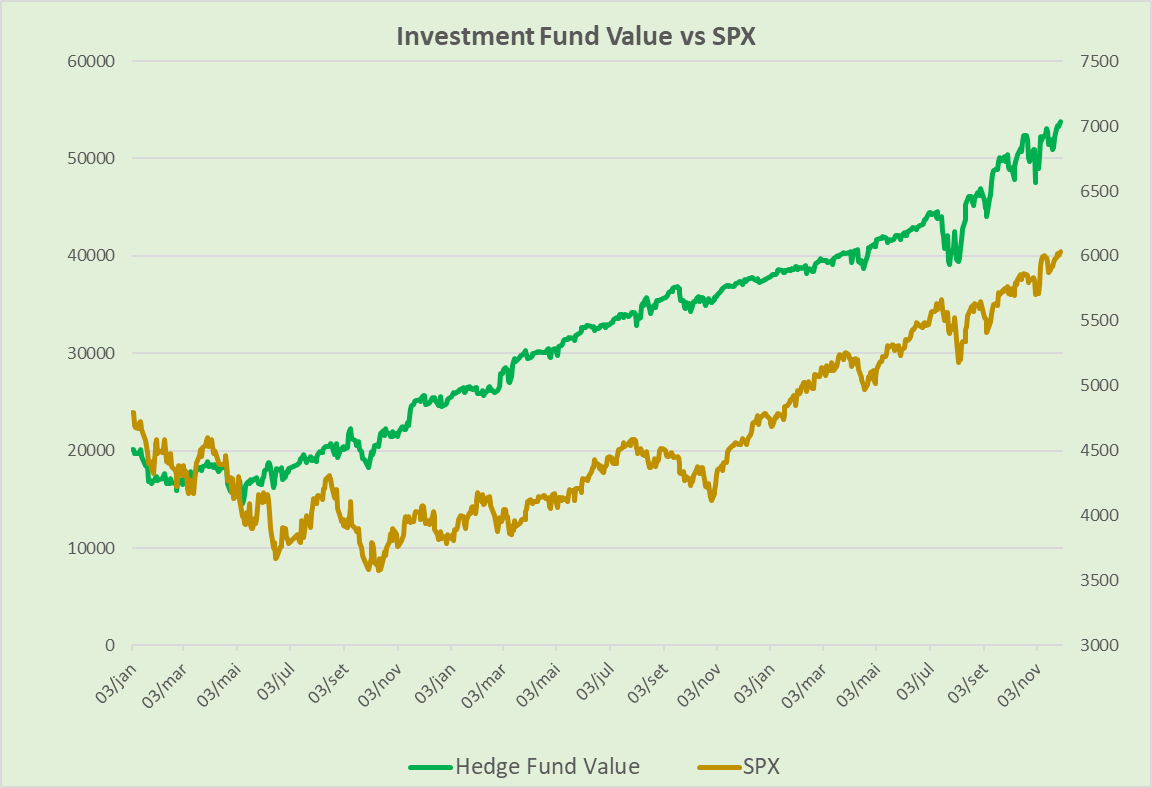

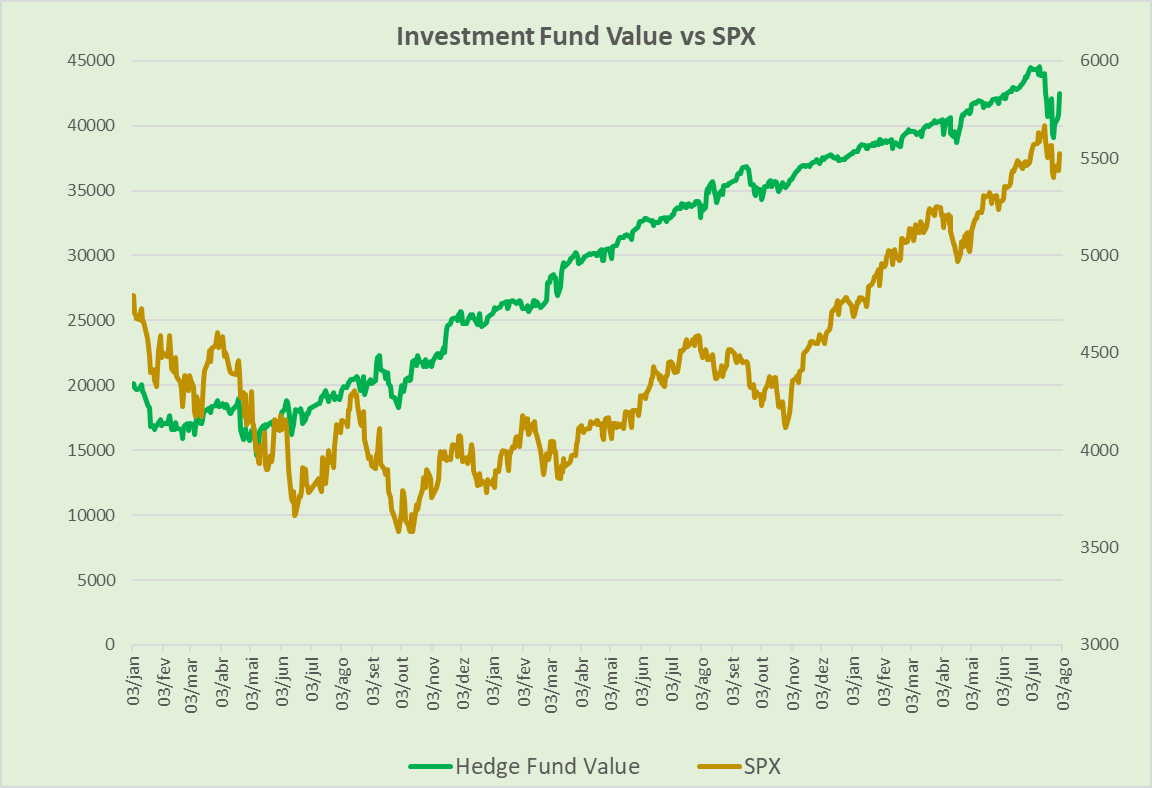

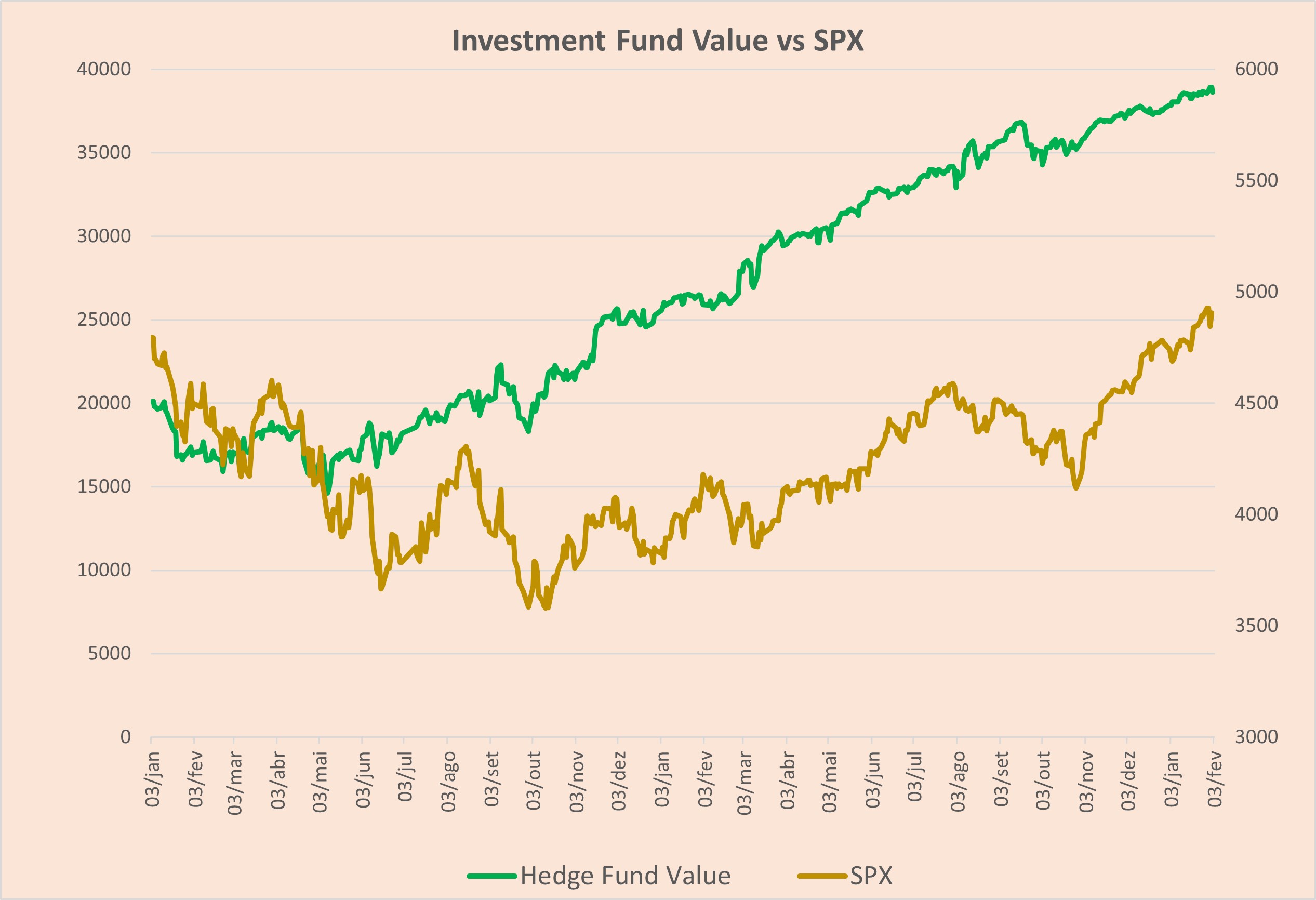

Since Jan22: +263% / SPX: +43%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

In December 2025, the S&P 500 (SPX) continued its strong year-end performance, reaching fresh all-time highs at 6,9345 late in the month amid optimism over earnings and expectations of further Fed rate cuts. From there the SPX did not recover and closed the month in negative territory (-0,3%). The Volatility remained subdued for most of the month, with the VIX trading in the low-to-mid teens, reflecting diminished fear and an easing of short-term volatility pressure compared with earlier months. During the month, we maintained our +Delta bias of the SPX Best Trades that contributed to the positive return. The VIX closed the month at a low reading (14.7). During the month, we closed two SPX Best Trades for a great profit ($2200 and $1500).

At the end of the month, there were 3 opened SPX Best Trades: 20FEB, 20MAR and 31MAR expirations. There is also an open SPY Ride Trade.

The Investment Fund closed the month and year with a value of $72.9k (+39% YTD) - a small gain of $770 for the month. This result reflected some losses that came from a Quants trade taken in the last week of the year. The 50% annual return goal was not achievable, but we succeeded in beating the SPX. The Fund continues to have a target of 50% annual for 2026.

Trading Account

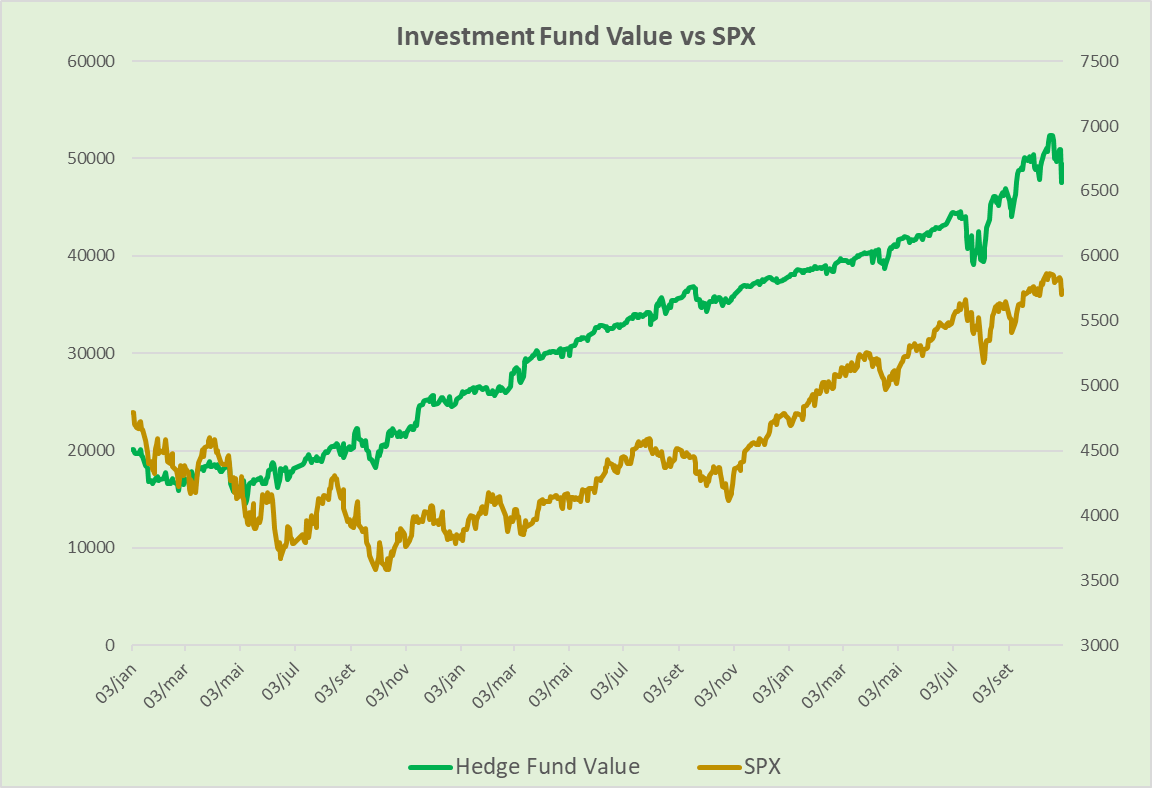

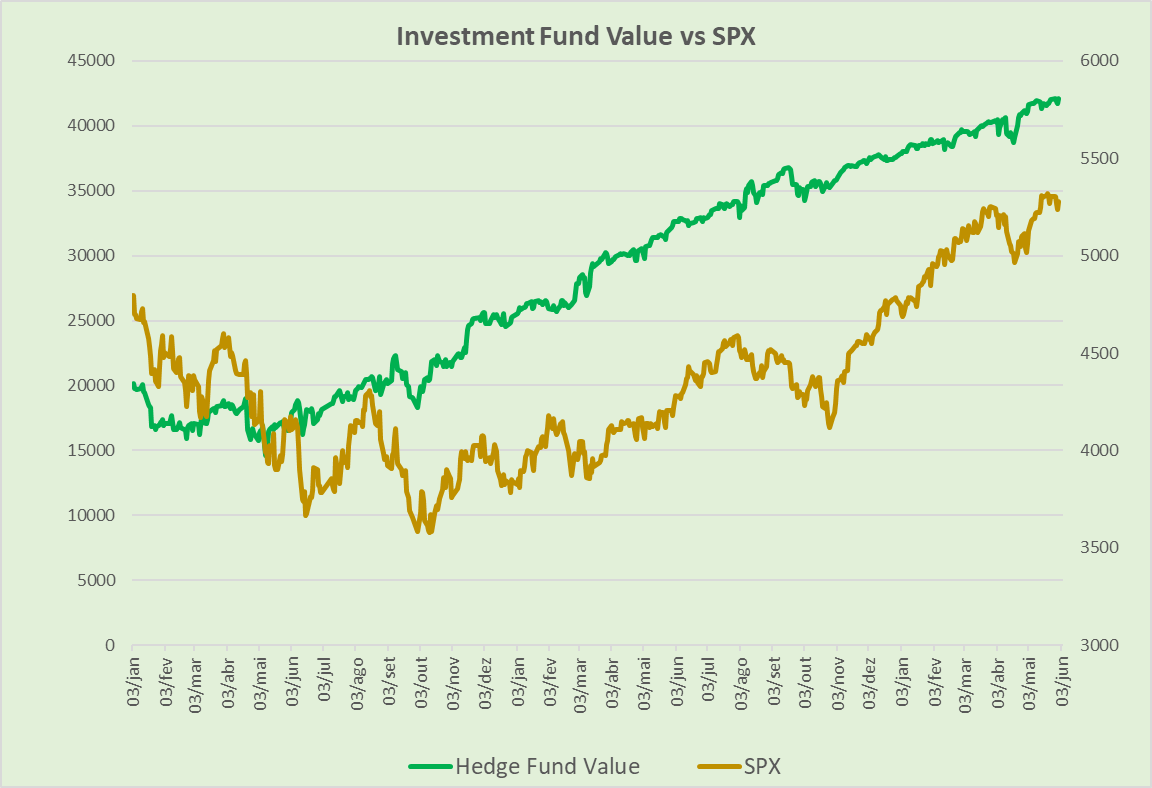

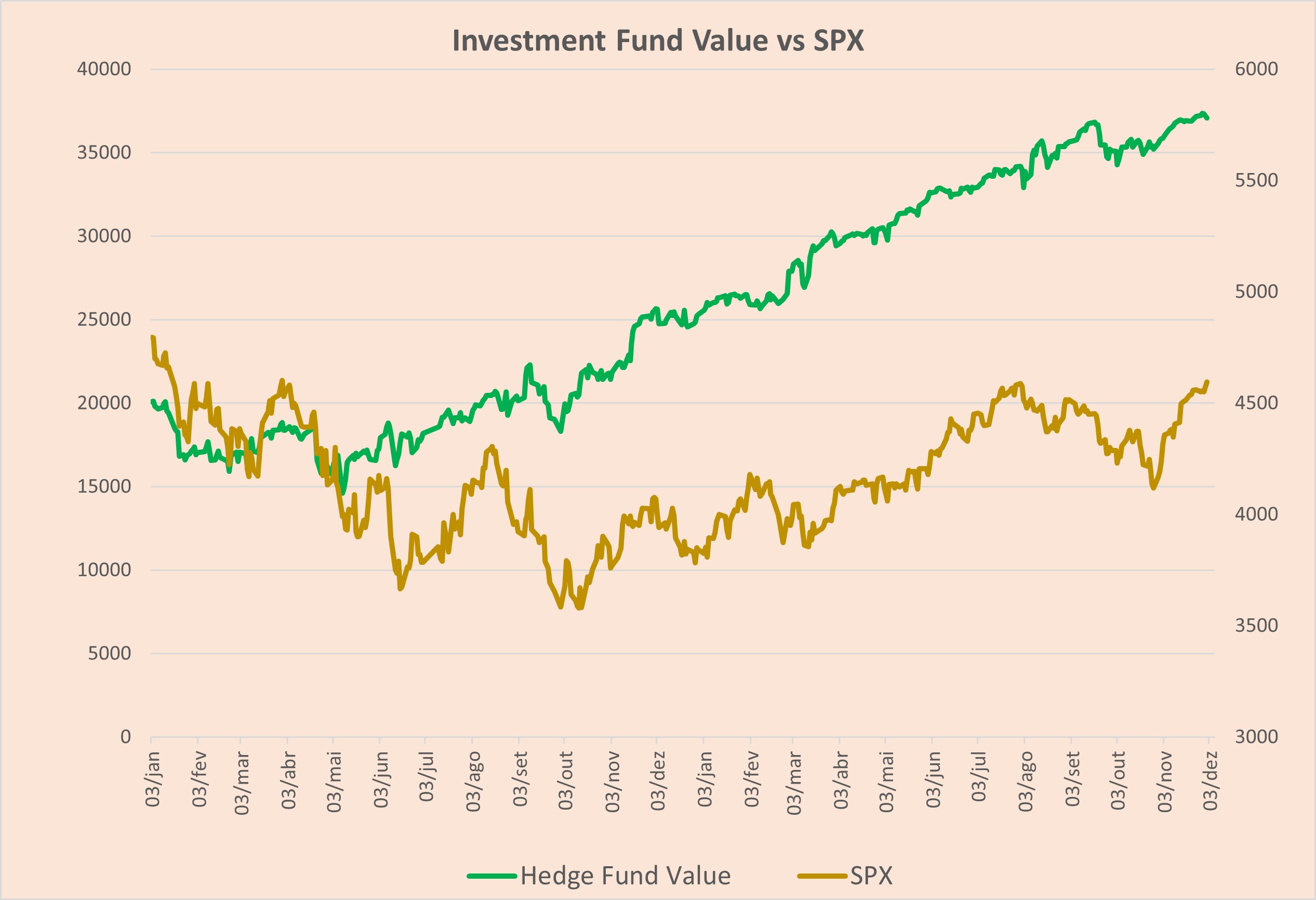

Since Jan22: +260% / SPX: +43%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

In November 2025, the SPX had a volatile but ultimately flat month, recovering from an early‐November selloff to finish roughly unchanged (+0,01%) versus October levels.

The VIX spiked into the high 20s during the risk-off phase but then fell back sharply, ending the month at 16.

Overall, the market priced in higher short-term volatility early in the month, but risk sentiment improved into the month-end as equities stabilized. This had a great positive impact on the Fund gain this month which closed at a record high. The Fund benefited from the overall SPX move-up and IV decay but also from 2 new strategies we are introducing: The "VIX Playbook" and "SPX Quants Trade". During the month, we maintained our +Delta bias of the SPX Best Trades that contributed to the positive return. The VIX closed the month at a mid level (16.3) but reached +27 during a big correction day. During the month we closed one SPX Best Trades for a big profit ($2200) and the VIX Vertical for $1100.

At the end of the month, there were 3 opened SPX Best Trades: 16JAN, 30JAN and 20FEB expirations. There is also a SPY Ride Trade and the SPX Quant Vertical. All open trades show unrealized profits.

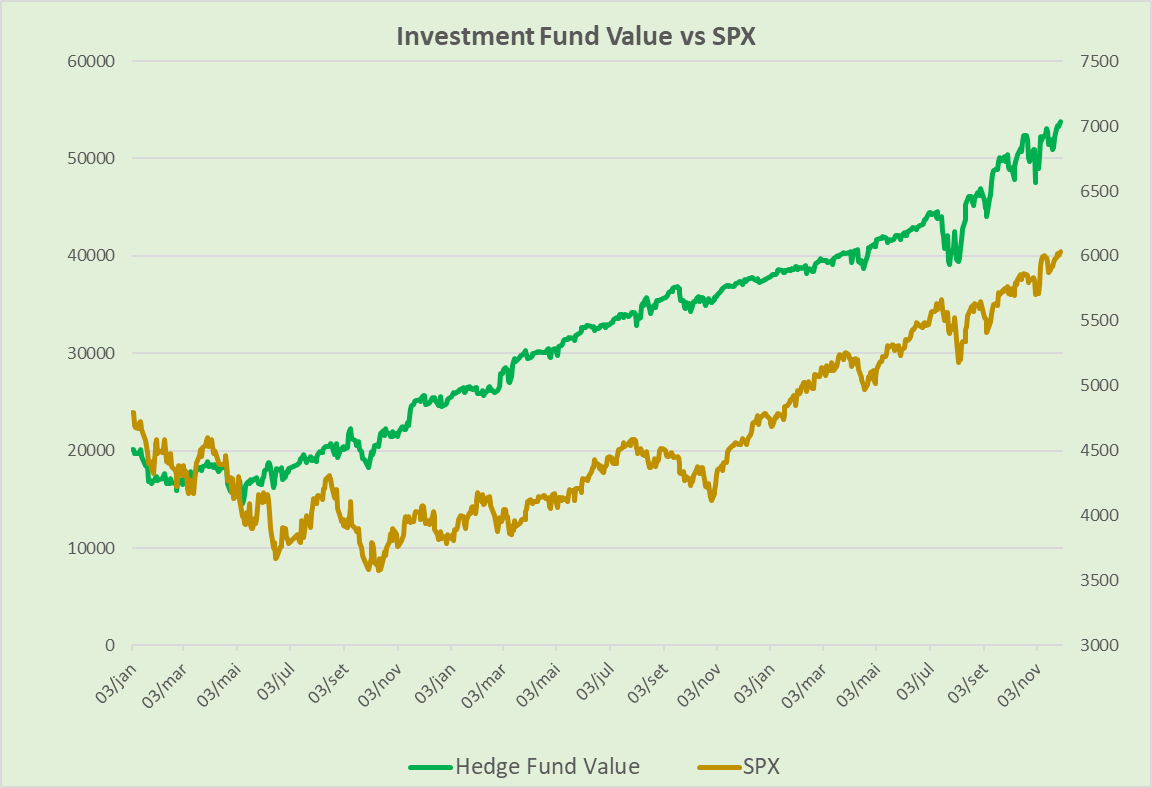

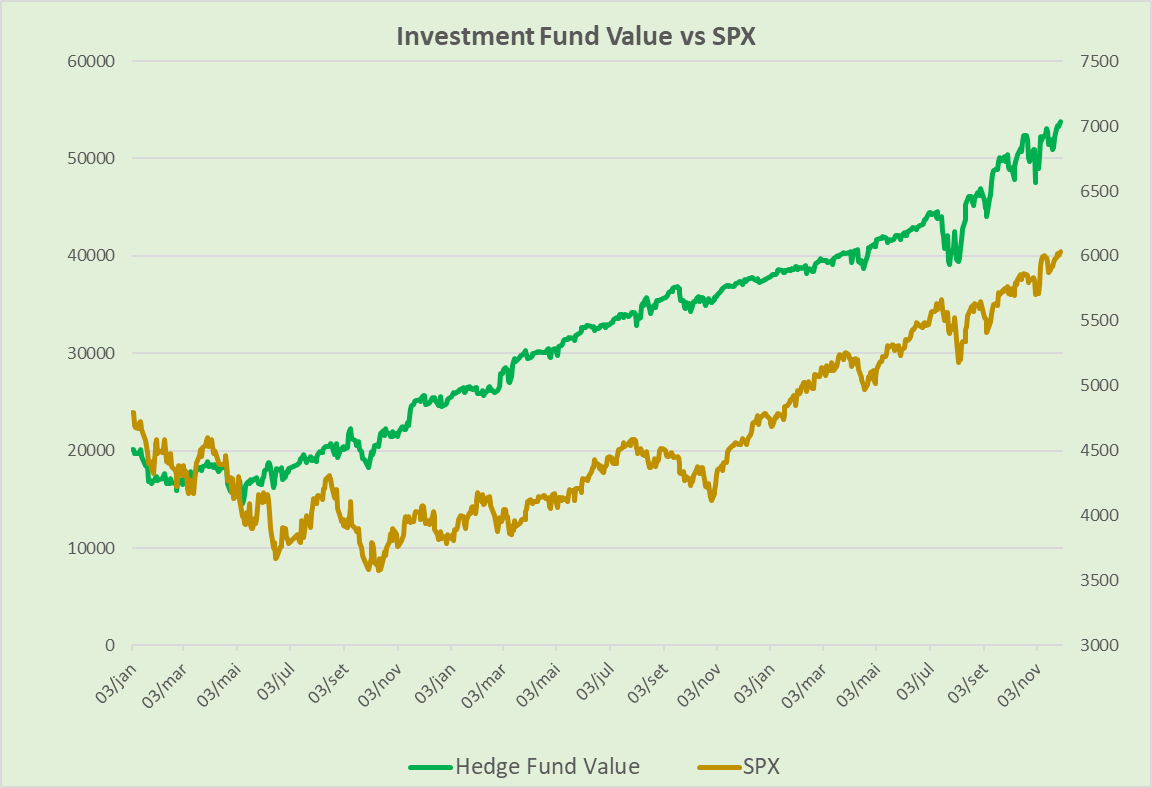

The Investment Fund closed the month with a value of $72.1k (+38% YTD) - a gain of $3600 for the month. The 50% annual return goal will be difficult to achieve. We should remain with the same risk profile and we will not try to reach the target increasing our trades risk profile. The Fund has a target of 50% annual return per year.

Trading Account

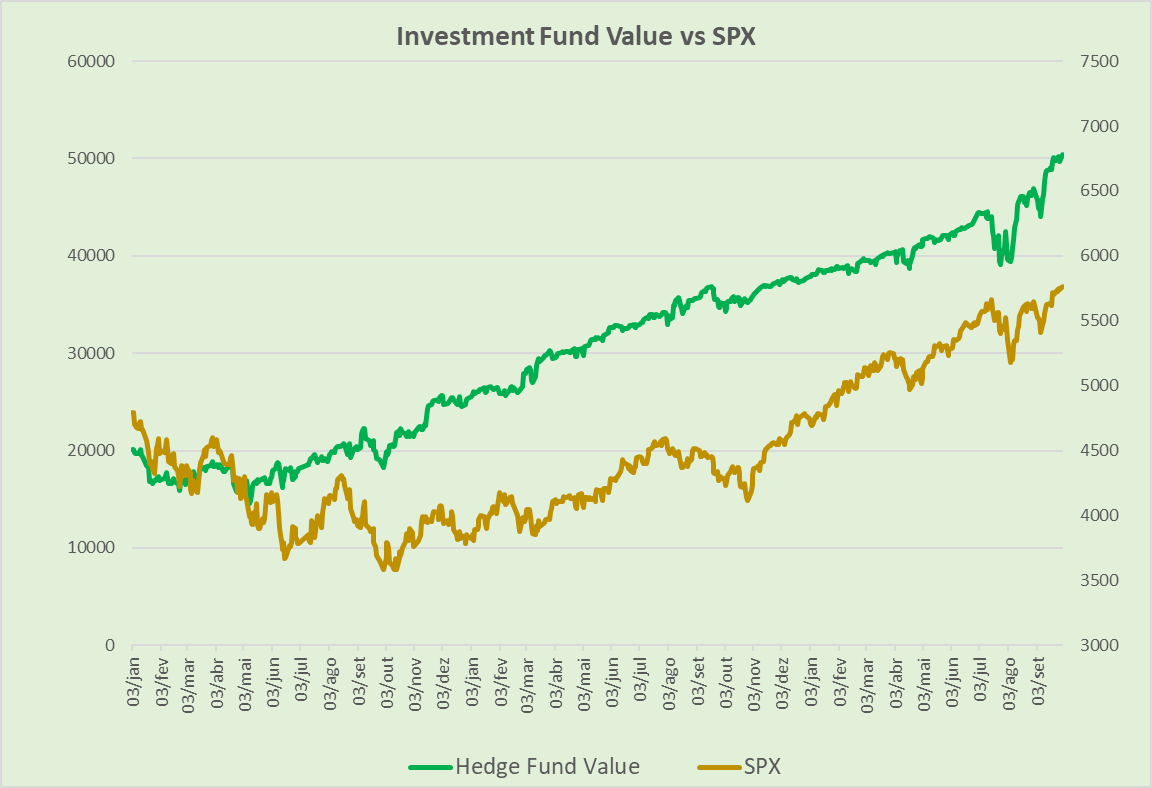

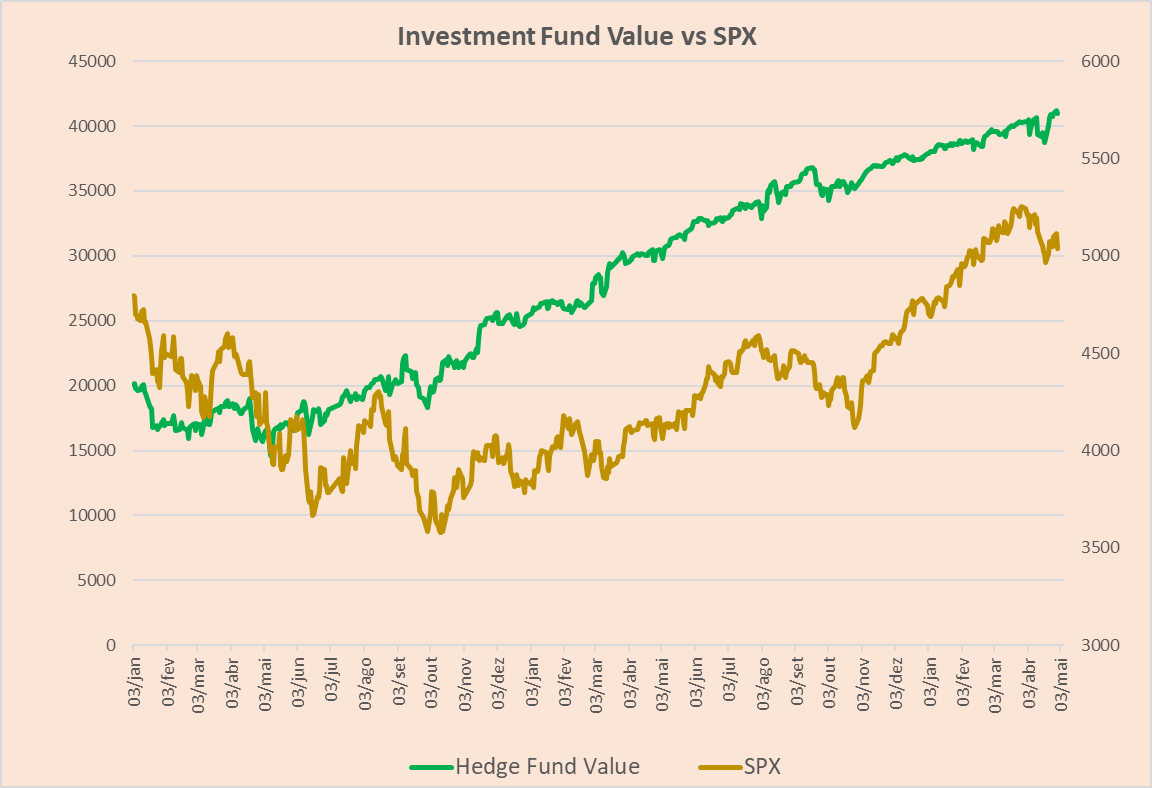

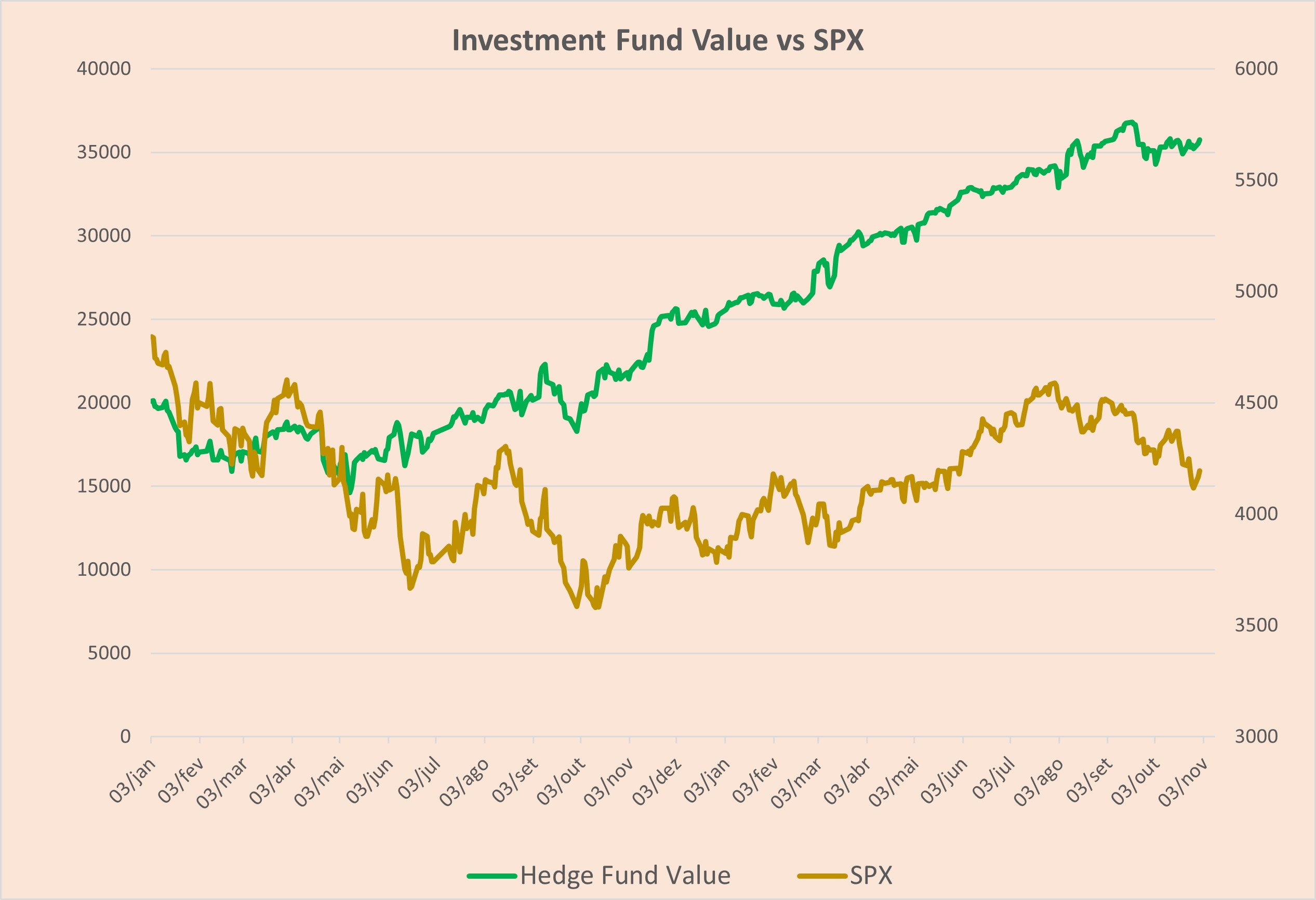

Since Jan22: +238% / SPX: +43%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The SPX gained roughly 2.3% in October, hitting multiple new all-time highs near 6,890, driven by strong mega-cap tech earnings, AI optimism, and easing expectations. The rally was narrow but powerful, with AI/tech leadership and strong earnings breadth offsetting worries around valuations and patchy macro signals. Despite record levels, VIX remained anchored in the mid-teens, signaling a confident but event-sensitive market backdrop. The Fund benefited from the overall SPX move-up and IV decay (we are mainly Vega negative). During the month, we maintained our +Delta bias of the SPX Best Trades that contributed to the positive return. During the month, we closed one SPX Best Trade at a loss to protect the portfolio.

At the end of the month, there were 3 opened SPX Best Trades: 21NOV, 28NOV and 19DEC expirations as well as a SPY Ride Trade. All under unrealized profits.

The Investment Fund closed the month with a value of $67.9k (+30% YTD) - a modest gain of $500 for the month. The 50% annual return goal will be very difficult to achieve. We should remain with the same risk profile and we will not chase it by increasing our trade risk profile.

Trading Account

Since Jan22: +236% / SPX: +39%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

This month delivered another strong contribution to the Fund’s performance. The SPX rose by roughly 3.5 % in September, defying the usual seasonal weakness and posting one of its best Septembers in over a decade. Volatility was generally benign: the VIX hovered in the mid-teens, ending the month around 16.1. The decline in implied volatility worked in our favor (we remain largely Vega-negative), while the upward drift in SPX allowed our +Delta positioning in the SPX Best Trades.

We captured profits on 2 Best Trades closed during the month (+$2900), reinforcing our view that disciplined adjustments and volatility decay can enhance returns even in moderately trending markets.

Overall, the combined effect of a rising SPX and a steady IV environment was favorable - the Fund benefited both from directional exposure and from the natural erosion of volatility.

At the end of the month, there were 3 opened SPX Best Trades: 31OCT, 21NOV and 28NOV expirations.

The Investment Fund closed the month with a value of $67.4k (+28.7% YTD) - a gain of $1900 for the month. The 50% annual return goal is still achievable, although a bit difficult because the IV is low (not too much premium to benefit). We should remain with the same risk profile and we will not try to reach the target by increasing our trade risk profile.

Trading Account

Since Jan22: +226% / SPX: +35%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

This month delivered another strong contribution to the Fund’s performance. The SPX rose by roughly 3.5 % in September, defying the usual seasonal weakness and posting one of its best Septembers in over a decade. Volatility was generally benign: the VIX hovered in the mid-teens, ending the month around 16.1. The decline in implied volatility worked in our favor (we remain largely Vega-negative), while the upward drift in SPX allowed our +Delta positioning in the SPX Best Trades to participate meaningfully.

We captured profits on 2 SPX Best Trades during the month with a total amount of circa $3000 added to the account, reinforcing our view that disciplined adjustments and volatility decay can enhance returns even in moderately trending markets.

Overall, the combined effect of a rising SPX and a steady IV environment was favorable — the Fund benefited both from directional exposure and from the natural erosion of volatility.

At the end of the month, there were 3 opened SPX Best Trades: 31OCT, 21NOV and 17JAN expirations. There is also a VXX Short Call Vertical, opened during the high IV environment that is showing a drawdown, but is under tight management to recover.

The Investment Fund closed the month with a value of $65.5k (+25% YTD) - a gain of $3100 for the month. The 50% annual return goal is achievable, although a bit difficult because the IV is low (not too much premium to benefit). We should remain with the same risk profile and we will not try to reach the target increasing our trades risk profile. The Fund has a target of 50% annual return per year.

Trading Account

Since Jan22: +210% / SPX: +32%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

In July, the SPX gained approximately 1.9%, marking its fourth consecutive monthly advance. The index reached a new all-time closing high of 6,501.86 on August 28. Strength was underpinned by optimism surrounding potential Fed rate cuts and continued AI-driven earnings momentum. The VIX ended August around 14.4, well below July's average of ~16.7, signaling a calmer but watchful market tone. The decreasing IV environment had a great positive impact on the Fund's gain this month. During the month, we maintained our +Delta bias of the SPX Best Trades, which also contributed to the positive return. During the month, we closed one SPX Best Trade for a nice profit ($980) and a SPY Ride Trade also at a profit ($985).

At the end of the month, there are 3 opened SPX Best Trades: 19SEP, 17OCT and 31OCT expirations. There is also a SPY Ride Trade. All trades are under unrealized profit. In the last trading day of August, we opened a "portfolio hedge" to prevent any correction that may happen.

The Investment Fund closed the month with a value of $65.5k (+25% YTD) - a gain of $3195 for the month. The 50% annual return goal is achievable. We should remain with the same risk profile and we will not try to reach the target by increasing our risk profile. The Fund has a target of 50% annual return per year.

Trading Account

Since Jan22: +198% / SPX: +29%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check an example here

The SPX began June in a consolidation phase but ended the month with strong upward momentum, ultimately gaining 5%. While implied volatility (IV) declined throughout the month, it didn’t drop as sharply as expected during the SPX rally — largely due to lingering uncertainty around the July 9 tariffs deadline.

Despite this, the Fund benefited from the SPX’s overall upward move and the gradual IV decay, as our positioning is primarily Vega-negative. Throughout the month, we maintained a +Delta bias in our SPX Best Trades, which contributed meaningfully to the positive performance.

The VIX ended the month at a moderate level of 16.7. As anticipated, the decline in volatility — even with this relatively high reading — worked in our favor.

Notably, we closed two SPX Best Trades for strong gains totaling $4,700. These trades were opened during periods of high volatility and closed as IV contracted, capturing both directional and volatility edge. These wins successfully offset the prior month’s losses, as previously indicated.

At the end of the month, there were 3 opened SPX Best Trades: 31JUL, 15AUG and 29AUG expirations.

The Investment Fund closed the month with a value of $59.9k (+14% YTD) - a gain of $1800 for the month. The 50% annual return goal continues to be achievable. We should remain with the same risk profile of the trades, not increasing it to try to reach the annual target. The Fund has a target of 50% annual return per year.

Trading Account

Since Jan22: +189% / SPX: +23%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The SPX started the month with a strong recovery, but in its second half, it is mainly in a consolidation phase. The IV started high (giving us good opportunities to open trades) but is is coming down slowly to the month end. This had a positive impact on the Fund gain this month. The SPX gained 6.1% in the month. The Fund benefited from the overall SPX move-up and IV decay (we are mainly Vega negative). During the month, we maintained our +Delta bias of the SPX Best Trades, which contributed to the positive return. The VIX closed the month at a relatively high reading (19). As anticipated, the drop in Volatility, despite this high reading, made the Fund gain. We closed one SPX Best Trade for a record loss (-$2900) - due to the high market swings during its life that were based on too many adjustments, penalizing its performance strongly. But, the other trades offset this negative result until the end of the month due to IV decay.

At the end of the month, there were 3 opened SPX Best Trades: 20JUN, 18JUL and 31JUL expirations. There is also a VXX Short Call Vertical (hedged), opened during the high IV environment that is showing a nice profit.

The Investment Fund closed the month with a value of $58.1k (+11% YTD) - a gain of $3200 for the month. The 50% annual return goal continues to be achievable. We should remain with the same risk profile of the trades, not increasing it to try to reach the annual target. The Fund has a target of 50% annual return per year.

Trading Account

Since Jan22: +173% / SPX: +16%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

April started in a strong negative mood, continuing with the correction from the previous month. The IV spiked in a strong selloff day when the SPX printed a year low at 4835. The IV peak, as expected, had a negative impact on our trades, especially the SPX Best Trades. After this day (7 Apr), the SPX started to recover and the IV reduced its value. In April, the SPX was practically unchanged for the month. During this month, we inverted those trades (turning them Delta negative) that benefited the negative move from the first part of the month. Then, we had to fight against the positive move of the SPX. There were 2 SPX Best Trades closed during the month: one closed at profit ($700 - the trade recovered from a big drawdown); and another that was closed at a loss ($3900). It was decided to close it at this loss and open a newer one at a longer term under high IV. This will help to capture more premium. We should have a long term target and is normal that some trades will be closed at a loss... the big swinging market is tough for everyone!

At the end of the month, there were 3 opened SPX Best Trades: 16MAY, 20JUN and 18JUL expirations. The VXX Short Call Vertical, opened during the high IV environment, is recovering from the drawdown.

The Investment Fund closed the month with a value of $54.8k (+4.7% YTD) - a gain of circa $200 for the month. The 50% annual return goal continues to be achievable, especially, if the IV continues to move down. The Fund has a target of 50% annual return.

Trading Account

Since Jan22: +171% / SPX: +17%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

March was a challenging month for our trades. It was mainly in a downtrend, despite having some recovery in the last days of the month. The IV was increasing, putting some additional challenges to our trades that became "depressed" and we needed to take them closer to expiration to capture profits (increasing Gamma risk). This move had a negative impact on the Fund for the month. The SPX lost circa 6% in the month and VIX closed at 21 (a high reading). Despite these moves and a challenging month, the Fund increased its value. During the month, we maintained our +Delta bias of the SPX Best Trades and succeeded in managing the trades that captured the time decay to offset the increased volatility. During the month, we closed one SPX Best Trade for a nice profit ($760), despite the challenging month.

At the end of the month, there were 3 opened SPX Best Trades: 17APR, 30APR and 16MAY expirations. There is also a VXX Short Call Vertical (Hedged) opened during the high IV environment that is showing a drawdown, but is under tight management to recover.

The Investment Fund closed the month with a value of $54.7k (+4.1% YTD) - a gain of $700 for the month. The 50% annual return goal is achievable, despite the high IV. We should remain with the same risk profile and we will not try to reach the target by increasing our risk profile. The Fund has a target of 50% annual return.

Trading Account

Since Jan22: +168% / SPX: +24%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

February can be divided into two trading periods for SPX: the first part had the index moving up and reaching an all-time high at 6147; the second part, after reaching this level, the SPX entered in correction mode, diving until 5860, although recovering in the last trading hour of the month, to close positive for the year (+1.2%). During this correction of circa 5%, the VIX spiked and reached values above 22, although closing the month shy of 20 at 19.6 - still a high reading. In February, the SPX lost 1.5% (or 85 points) with the level of 5860 acting as support in the last trading days of the month. The Fund is currently up approximately 2.8% for the year, although had reached 4.5% in the middle of the month. Currently, continues slightly above the SPX’s performance.

The SPX Best 21FEB trade was closed for a profit of $575, an average one for this strategy. As we begin a new year, we reaffirm our ambitious 50% return goal for the Fund. At the end of the month, there were 3 opened SPX Best Trades: 21MAR, 17APR and 30APR expirations, and one SPY Ride Trade.

The Investment Fund closed the month with a value of $53.8k (+2.8% YTD) - a gain of circa $150 for the month. The Fund value is a bit depressed due to the high environment that penalizes its value. Existing trades are well positioned vs SPX price. Our annual return target of 50% continues in place and is reacheable for 2025.

Trading Account

Since Jan22: +167% / SPX: +29%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The first trading days of January brought a small correction for the SPX. However, the following weeks sessions saw a recovery to new all-time highs. In the last week of the month, the SPX experienced a brief pullback before rebounding, coming just shy of the all-time high at 6128. On the final trading day of the month, despite opening strongly positive, the SPX moved lower and closed down 0.50%. Implied volatility (IV) remained elevated for most of the month (above 15), especially until the appointment of the new President. For January, the SPX gained 2.7% (or 158 points) but was ultimately rejected at the strong resistance level of 6100. The Fund is currently up approximately 2.5% for the year, slightly trailing the SPX’s performance.

The SPX Best 31JAN trade was closed for a profit of $520, an average one for this strategy. As we begin a new year, we reaffirm our ambitious 50% return goal for the Fund.

At the end of the month, there were 3 opened SPX Best Trades: 21FEB, 21MAR and 17APR expirations, one SPY Ride Trade and a VXX Black Hole.

The Investment Fund closed the month (and Year) with a value of $53.7k (+2.5% YTD) - a gain of circa $1200 for the month. Our annual return target of 50% continues for 2025. Probably, I will have a lower risk / conservative approach for the new year.

Trading Account

Since Jan22: +161% / SPX: +23%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The last month of the year started with some consolidation for the SPX. It reached a few All time-highs but most of the remaining days were down moves, despite a shy recovery in-between S/R key regions. The last days of the month (and year) brought increased IV, which penalized our trades, and a correction for the SPX. The SPX lost 2.5% (or 150 points) in the month, closing near a key support (5865). Probably this region will be broken at the beginning of the new year. The Fund suffered from the increase in IV (and SPX down move) as we have mainly Vega negative positions with our SPX Best Trades. Nevertheless, the 2 trades closed produced good profits ($680 and $1640). On the negative side, we had the VXX Short Call Vertical that was opened during the summer IV peak but could not close it at a profit. Its loss offset the gains in our stellar SPX Best trades!

At the end of the month, there were 3 opened SPX Best Trades: 31JAN, 21FEB and 21MAR expirations.

The Investment Fund closed the month (and Year) with a value of $52.4k (+39% YTD) - a loss of $1400 for the month. The 50% annual return goal was not achieved in 2024. This was mainly due to an increased IV in the last trading days of the year and the loss of the VXX Short Call Vertical. We should remain with the same risk profile for next year maintaining its annual 50% target return.

Trading Account

Since Jan22: +168% / SPX: +26%

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

November started with the presidential election outcome. Until this day, the IV was high but, soon after the result was cleared, the IV moved lower. This had a great positive impact on the Fund gain this month. The SPX gained almost 6% in the month, closing at an all-time high. Nevertheless, its price produced relevant swings throughout the entire month. The Fund benefitted from the overall SPX move-up and IV decay (we are mainly Vega negative). During the month, we maintained our +Delta bias of the SPX Best Trades that contributed to the positive return. The VIX closed the month at a low reading (13.5). As anticipated, the drop in Volatility made a full recovery. During the month we closed two SPX Best Trades for a great profist ($1700 and $1000).

At the end of the month, there were 3 opened SPX Best Trades: 20DEC, 17JAN and 20DEC expirations. There is also a VXX Short Call Vertical, opened during the high IV environment that is showing a drawdown, but is under tight management to recover.

The Investment Fund closed the month with a value of $53.8k (+43% YTD) - a gain of $6200 for the month. The 50% annual return goal is achievable, although a bit difficult because the IV is low (not too much premium to benefit). We should remain with the same risk profile and we will not try to reach the target increasing our trades risk profile. The Fund has a target of 50% annual return per year.

(since Jan22: 146% / SPX +20%)

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

October was a month where SPX did not move too much to either direction. But, its last day was completely different from the rest and SPX moved down sharply and VIX spiked. This resulted in a big move down of the value of the Investment Fund due to our +Delta positioning and, as we know, our main strategies like the SPX Best Trade are - Vega, which means they suffer when volatility spikes. The SPX closed the month losing 1%. The VIX closed the month spiking to 23, a high reading. This last day affected the performance of the Hedge Fund which dropped about 3.5%. This will be fully recoverable if the IV drops and the market resumes moving up. This is expected due to the next month's presidential election which should drive volatility down. During the month we closed one SPX Best Trade for a big profit ($1600) and opened a new one for a longer-term expiration, to reduce portfolio risk. Due to high volatility during the month, there were no 15 SPY Put Spread trades opened.

At the end of the month, there were 3 opened SPX Best Trades: 15NOV, 29NOV and 20DEC expirations. There is also a VXX Short Call Vertical, opened during the high IV environment that is showing a drawdown, but is under tight management to recover.

The Investment Fund closed the month with a value of $49.4k (+31.2% YTD) - a loss of $1060 for the month. The 50% annual return goal is achievable if the Volatility moves down and SPX resumes its move up. The Fund has a target of 50% annual return per year.

(since Jan22: 151% / SPX +20%)

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

After the tough month of August (big correction and increasing IV), September brought a recovery. The SPX closed the month gaining 2.0%. The VIX closed the month at around 17, which is above average, but a reduction from the previous month. During this month the Hedge Fund had a big recovery (+7,2% or $3460) due to the decrease in volatility after the big correction of August and SPX strong move up. Note that we opened several trades under high IV that benefited strongly from the IV decrease. During the month we closed one SPX Best Trade for a big profit ($1800). Due to high volatility during the month there were no 15 SPY Put Spread trades opened.

At the end of the month, there were 3 opened SPX Best Trades: 31OCT, 15NOV and 29NOV expirations. There is also a VXX Short Call Vertical, opened during the high IV environment that is under a small drawdown.

The Investment Fund closed the month with a value of $50.4k (+34.0% YTD) - a gain of $3460 for the month. The annual return goal is getting difficult despite the big recovery during this month. The Fund has a target of 50% annual return per year.

(since Jan22: 134% / SPX +18%)

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

August brought a correction for the SPX in the first days but then the SPX recovered until the end of the month. The SPX closed the month gaining 2.3%. The VIX closed the month at around 15, which is above average. During this month the Hedge Fund had a big appreciation (10.5% or $4400) due to the decrease in volatility after the big correction and the past month that it decreased. Note that we opened several trades under high IV that benefited strongly from the IV decrease. During the month we closed one SPX Best Trade for a small profit (after a great recovery from a significative drawdown - but recoverable as it was proved). The SPY Ride Trade was closed on the last trading day of the month for a nice profit - above its profit target! Due to high volatility during the month there were no 15 SPY Put Spread trades opened.

At the end of the month, there were 3 opened SPX Best Trades: 20SEP, 18OCT and 31OCT expirations. There is also a VXX Short Call Vertical, opened during the high IV environment that is now in profit.

The Investment Fund closed the month with a value of $46.9k (+24.8% YTD) - a gain of $4400 for the month. The annual return goal is getting difficult despite the big recovery during this month. The Fund has a target of 50% annual return per year.

(since Jan22: 111% / SPX +15%)

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The SPX was mostly higher until the mid July. After this period the SPX took a dive and IV became higher and higher, putting our trades in a loss. The VIX closed the month at around 17, which is a high reading. During this month the Hedge Fund decreased its value circa 3.5% (or $1250). During the month we closed 2 SPX Best Trades one for a small profit and the other with a small loss of $350. The 15 SPY Put Spread trades produced a combined profit of $400 with 1 loss and 5 wins in the month.

At the end of the month there are 2 opened SPX Best Trades: 16AUG and 20SEP expirations. The opened SPY Ride Trade is doing well, despite the increase in IV.

The Investment Fund closed the month with a value of $42.4k (+12.8% YTD) - a loss of $1250 for the month. The annual return goal is turning more difficult to achieve, after this month with a loss.

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The SPX was mostly higher since the beginning of the month until reaching a consolidation zone for the last 2 weeks. The VIX was under its lows: between 12 and 13. During this month the Hedge Fund increased 3.8% (or $1600). During the month we closed one SPX Best Trade for a a profit of $800.

After closing that trade, I opened another SPX Best Trade: for AUG expiration. At the end of June there are 3 open SPX Best Trades (19JUL, 31JUL and 16AUG). All of them are well-positioned vs SPX price to capture options time decay. The opened SPY Ride Trade of last month is now above the profit target. But, the month's biggest news was the launch of a new directional strategy (15 SPY Put Spread) that already contributed with a winner for the fund and has now 2 opened trades.

The Investment Fund closed the month with a value of $43.7k (+16.2% YTD) - a gain of $1600 for the month. I continue to maintain the 50% annual return target for the year. Currently, the 3 opened SPX Best Trades have a combined profit of circa $400, but a potential profit of circa $2000).

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The SPX was mostly higher since the beginning of the month until reaching a consolidation zone, from where, in the last trading week, entered in a healthy correction. Despite this negative performance of the last week, the Hedge Fund gained 2.7% (or $1100). During the month we closed two SPX Best Trades for a a total profit of $1600 - one $635 and the other $985. The SPX Strategy returned to profits due to the help of the decreasing volatility the helps it.

After closing those trades, I opened 2 new SPX Best Trades: one at the monthly expiration (JUL) and the other at the end of JUL that are both in profit.

At the end of Mayl, there are 3 open SPX Best Trades (21JUN, 19JUL and 31JUL) - all in profit. All of them are well-positioned vs SPX price to capture options time decay. I also decided to open a SPY Ride Trade because the IV is low and it will contribute to hedge against any volatility spike and capture time decay.

The Investment Fund closed the month with a value of $42.1k (+11.8% YTD) - a gain of $1100 for the month. I continue to maintain the 50% annual return target for the year. Currently, the 3 opened SPX Best Trades have a combined profit of circa $600, but a potential profit of circa $1800).

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

Since the beginning of April, the SPX started a correction. The SPX lost about 4%, despite the recovery of the last days of the month. Despite this negative behavior, the Hedge Fund gained 1.8% (or $990). During the month we closed the both the 19APR and 30APR SPX Best Trades for a small loss (-$100) and small profit ($70). The closing of both trades was due to account protection and risk management, exchanging these short-term trades for newer ones with higher timeframes and better positioned. Since last year, I decided to be conservative in the adjustments and trade closing/opening to avoid excessive volatility in the Fund value. Also, to capture the volatility spike, I opened 2 VXX Short Vertical trades that combined produced a small profit, as the first had a negative performance.

After closing those trades, I opened 2 new SPX Best Trades: one at the monthly expiration (JUN) and the other at the end of MAY. This will contribute to spread the risk.

At the end of April, there are 3 open SPX Best Trades (17MAY, 30MAY and 21JUN) - all in profit. All of them are well-positioned vs SPX price to capture options time decay. Market bias changed to negative. At the moment, the market is under a correction.

The Investment Fund closed the month with a value of $41k (+8.9% YTD) - a gain of about $990 for the month. I continue to maintain the 50% annual return target for the year. Currently, the 3 opened SPX Best Trades have a combined profit of circa $1000, but a potential profit of circa $2200).

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

March was very similar for SPX price action when compared with February. The SPX continued its move up and it gained 10.1% in 2024. Also, in the last trading day of the month, it reached another all-time high at 5264.85. Our Hedge Fund also improved its return and is gaining 7.5%. During the month we closed the MAR SPX Best Trade for a good profit ($545). I continue to be conservative in the adjustments to prevent any unexpected market correction. This penalizes a bit the Fund return but is safer.

After closing the MAR trade, I opened 2 new SPX Best Trades: one at the monthly expiration (MAY) and the other at the end of APR. This will contribute to spreading the risk.

We should continue to be vigilant and conservative to protect the fund value in case of a fast correction with a spike in IV.

At the end of March, there are 3 open SPX Best Trades (19APR, 30APR and 17MAY) - all in profit. All of them are well-positioned vs SPX price to capture options time decay.

Market bias should continue to the upside (all market internals and technicals are pointing to it) but we should expect a correction. The Investment Fund closed the month with a value of $40.2k (+7.5% YTD) - a gain of about $550 for the month. For 2024, I continue to maintain the 50% annual return target for the year. Currently, the 3 opened SPX Best Trades have a combined profit of circa $1200, but a potential profit of circa $2000).

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

In February the SPX continued its move up and is now gaining 7.8% in 2024 and closed the week at a all-time high. Our Hedge Fund is also in positive territory gaining 5.1%. It is expected that during the next week if the SPX does not move too much it will continue to grow due to the high Theta of the MAR SPX Best Trade. I continue to be conservative in the adjustments made and this caused the Fund not to appreciate as much as the SPX itself.

During the next week, I expect to close the MAR SPX Best Trade but will open 2 new SPX Best Trades in different expirations to spread the risk and work with 3 trades at each moment, instead of 2 that I had traded for the last 2 years.

We should continue to be vigilant and conservative to protect the fund value in case of a fast correction with a spike in IV.

At the end of February, there are 2 SPX Best Trades (MAR and APR) both in profit. Both are well-positioned vs SPX price and to capture nice options time decay.

Market bias should continue to the upside (all market internals and technicals are pointing to it) but we should expect a correction. The Investment Fund closed the month with a value of $39.7k (+5.1% YTD) - a gain of about $800 for the month. For 2024, I continue to maintain the 50% annual return target for the year. Currently, the two open SPX Best Trades (MAR and APR) have a combined small combined profit of about $800, but a potential profit of circa $1400).

During February, I opened one Earnings trade, with a break-even trade.

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The first month of the year brought a positive return for the Hedge Fund reaching a return of 3.4%. The SPX grew 1.6% having printed some higher highs in the last trading days of January. Nevertheless, this long wave up was somehow interrupted by smaller corrections. Which is normal market behavior. In the first week of the year, the SPX Best Trade was closed for a $600 profit, which was good given the fact it suffered several adjustments. The market continues to be in a strong positive momentum, but we need to keep our guidelines to protect the fund value in case of a fast correction with a spike in IV.

At the end of January, there are 2 SPX Best Trades (FEB and MAR) both in profit. Both are well-positioned vs SPX price and to capture nice options time decay.

Market bias should continue to the upside (all market internals and technicals are pointing to it) but we need to protect our returns and funds. The Investment Fund closed the month with a value of $38.9k (+3.4% YTD) - a gain of about $1200 since the start of the year. For 2024, I continue to maintain the 50% annual return target for the year. Currently, the two open SPX Best Trades (FEB and MAR) have a combined small combined profit of about $500, but a potential profit of circa $1800).

During January, I did not open any Earnings trades.

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as announcing my trades live in the trading room. Everyone following my trades will also have their rationale and filled prices. I am only sharing trades that I am assuming risk. Check it here

The year reached an end and the Investment Fund increased its value almost reaching the 50% target return at 49%. From my perspective, this was a great success because of the challenging trading year! Like in November, the month of December brought again a strong market recovery. And I assume I was too conservative on the expectation of a correction, leaving the trades with negative Delta to defend them in case of an event. That did not happen and the Fund did not grow too much this month, despite the SPX 4.4% appreciation.

During December we closed the DEC SPX Best Trade for a small profit ($250) and opened the FEB trade. The JAN SPX Best Trade presents a small profit and is well-positioned to deliver good profits if the market does not retract violently. In the case of this happening, I opened a "protective" SPY Straddle to benefit from any crash and IV Spike. Market bias should continue to the upside (all market internals and technicals are pointing to it) but we never know, after this long straight up wave. The Investment Fund closed the month with a value of $37.6k (+48.7% YTD) - a gain of about $400 compared with the past month's closing value. Next year, I continue to maintain the 50% annual return for the year. Currently, the account has only two open SPX Best Trades : JAN and FEB expirations under a combined small combined profit, but a potential additional profit of circa $2500).

During November, I opened and closed two Earnings trades that delivered small profits and no losses (in a separate account).

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as in the trading room. Everyone following my trades will also have them with all the details and filled prices. I am only sharing trades that I am assuming risk. Check here

November brought a big recovery for the SPX. The broad market index gained circa 9%. At the end of the month, the SPX almost touched the high of the year (July). Inversely, the VIX moved down to close the month at a low reading (12.5). This market behavior helped the hedge fund to gain.

During November we closed the NOV SPX Best Trade and opened the JAN trade. The NOV trade produced a small profit, after recovering from a drawdown. The DEC SPX Best Trade also recovered from a big drawdown. But because the IV was decreasing, options time decay was on our side and the correct adjustments were made, the trades are now very well positioned and present attractive profit targets. If the market retracts and/or stays flat from the current levels, the trades will deliver nice profits. The Investment Fund closed the month with a value of $37.2k (+47.1% YTD) - a gain of about $1500 compared with the past month. I continue optimistic about reaching the 50% target by the end of the year. Currently, the account has only two open SPX Best Trades : NOV and JAN expirations under a combined profit of $300 (but a potential additional profit of circa $2000).

During November, I opened and closed a couple of Earnings trades that delivered small profits and no losses (in separate account).

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as in the trading room. Everyone following my trades will also have them with all the details and filled prices. I am only sharing trades that I am assuming risk. Check here

October brought a high volatility month with the SPX losing about 2%. It started recovery, but resistance at 4380 was strong enough to be broken and the market fell from that point. The VIX closed the month at a high reading (18.05) but was above 20 for several days. In the last 2 days of the month, the SPX recovered and the implied volatility was reduced, helping the hedge fund to increase its value.

During October we did not close any of the open SPX Best Trades. I am letting the NOV trade be opened a few more days than I usually do because I want to capture its value increase from high Theta (options time decay) and the SPX price is well positioned in the structure. It is now at break-even but it should be closed soon. The DEC SPX Best Trade was also adjusted due to SPX's strong price move down but it is well positioned and recovering from its drawdown. It was opened at a time when IV was relatively low and currently is high, penalizing the trade. But, its drawdown is fully recoverable if the market stays flat or recovers. The Investment Fund closed the month with a value of $35.7k (+41.3% YTD) - a gain of about $700 compared with the past month. I remain optimistic about reaching the 50% target by the end of the year. Currently, the account has only two open SPX Best Trades for the NOV and DEC expirations under a combined drawdown of $1000 (but a potential profit of circa $2000).

There are no Earnings trades opened at the moment (separate account).

Trading Account

29 Sep 2023

Unlike many options websites or options instructors, I am publishing my results! With Thinkorswing platform screenshots for full transparency as well as in the trading room. Everyone following my trades will also have them with all the details and filled prices. I am only sharing trades that I am assuming risk. Check here

The month of September is being negative for the SPX. It started with a small consolidation but when it broke to the downside, the SPX continued in correction mode until the end of the month. Consequently, its options IV spiked, also measured by the VIX...

On 19th of September, we closed the OCT SPX Best Trade for another big profit ($1200). We could have let the trade expire and profits could have been 3x but, risk management best practices forced us to close the trade! We continue to maintain 2 SPX Best Trades opened to capture options time decay. They present a drawdown at the moment due to the increased IV we are experiencing at the moment. Nevertheless, they are defended from additional downside and should start to recover if the market also recovers or enters a consolidation phase. At the moment the opened trades are using NOV and DEC expirations. Both are "soft hedged". The Investment Fund closed the month with a value of $35.1k (+38.7% YTD) - a small loss compared with past month. I remain highly optimistic about reaching the 50% target by the end of the year. Currently, the account has only two open SPX Best Trades for the NOV and DEC expirations under a combined drawdown of $1300 (but a potential profit of circa $2500).

There are no Earnings trades opened at the moment (in a separate account).

Trading Account

31 Aug 2023

Trading Account

31 Jul 2023

Trading Account

30 Jun 2023

Trading Account

1 Jun 2023

Trading Account

28 April 2023

Trading Account

31 Mar 2023

Trading Account

28 Feb 2023

Trading Account

31 Jan 2023

Trading Account

30 Dec 2022

Trading Account

30 Nov 2022

Trading Account

31 Oct 2022

Trading Account

7 Oct 22

Trading Account

Trading Account